WRITER'S DIRECT DIAL

(852) 3551-8690

WRITER'S E-MAIL ADDRESS

ning.zhang@morganlewis.com

October 15, 2021

VIA EDGAR

Ms. Aamira Chaudhry

Mr. Lyn Shenk

Office of Trade & Services

Division of Corporation Finance

Securities and Exchange Commission

100 F Street, NE

Washington, D.C. 20549

|

|

Re: |

ATA Creativity Global |

|

|

|

Filed April 13, 2021 |

|

|

|

Form 6-K |

|

|

|

Filed August 13, 2021 |

|

|

|

File No. 001-33910_ |

|

Ladies and Gentlemen:

On behalf of ATA Creativity Global (the “Company”), set forth below are the Company’s responses to your comment letter dated September 23, 2021 (the “Letter”) with respect to the above-referenced Form 20-F (the “2020 Form 20-F”) filed with the Securities and Exchange Commission (the “Commission”) on April 13, 2021 and Form 6-K (the “Form 6-K”) furnished with the Commission on August 13, 2021.

October 15, 2021 - Page 2

For your convenience, we have reproduced the comments from the Commission’s staff (the “Staff”) in bold and Italic in front of the related response. All references in the Company’s responses to pages and captioned sections are to the 2020 Form 20-F and Form 6-K. Capitalized terms used in this letter and not otherwise defined herein have the meaning ascribed to them in the 2020 Form 20-F and Form 6-K.

October 15, 2021 - Page 1

Form 6-K filed August 13, 2021

Exhibit 99.1, page 2

The Company focuses on creative arts education and experiential learning instead of tutoring services on academic subjects for students in compulsory education. As disclosed in the Form 6-K, the Company does not anticipate its business to be materially impacted by the Opinion, and below the Company respectfully advises the Staff its detailed analysis on the applicability of the Opinion and the Company’s compliance plan. Once the Company receives your clearance on the analysis below, the Company will furnish a new Form 6-K containing the related disclosure.

The Opinion and Related Regulations

On July 24, 2021, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council issued the Opinions on Further Alleviating the Burden of Homework and After-School Tutoring for Students in Compulsory Education (the “Opinion”), which sets out a series of operating requirements on after-school tutoring institutions focusing on compulsory education, including, among other things, (i) local government authorities shall no longer approve any new after-school tutoring institutions providing tutoring services on academic subjects for students in compulsory education (the “Academic AST Institutions”), and all the existing Academic AST Institutions shall be registered as non-profit entities, and local government authorities shall no longer approve any new after-school tutoring institutions providing tutoring services on academic subjects for pre-school-age children and students in grade ten to twelve; (ii) online Academic AST Institutions that have filed with the local education administration authorities will be subject to review and re-approval procedures by competent government authorities, and any failure to obtain such approval will result in the cancellation of its previous filing and ICP license; (iii) Academic AST Institutions are prohibited from raising funds by listing on stock markets or conducting any capitalization activities, and listed companies are prohibited from investing in Academic AST Institutions through capital markets fund raising activities, or acquiring assets of Academic AST Institutions by paying cash or issuing securities; (iv) foreign capital is prohibited from controlling or participating in any Academic AST Institutions through mergers and acquisitions, entrusted operation, joining franchise or variable interest entities; (v) after-school tutoring institutions shall not provide tutoring services on academic subjects during national holidays, weekends and school breaks, or engage foreign teachers residing overseas to carry out training activities; (vi) fees charged for academic subjects tutoring in

October 15, 2021 - Page 2

compulsory education will need to follow the guidelines from the government to prevent any excessive charging or excessive profit-seeking activity; and (vii) government authorities will implement risk management and control for the pre-collection of fees by after-school tutoring institutions with requirements such as setting up third-party custodians and risk reserves, and strengthen supervision over loans regarding tutoring services. The Opinion further provides that administration and supervision over academic after-school tutoring institutions for students on grade ten to twelve shall be implemented by reference to the relevant provisions of the Opinion.

On July 28, 2021, the PRC Ministry of Education issued a notice (the “Notice”) to further clarify the scope of academic subjects in China’s compulsory education system. The Notice states that academic subjects include the following courses provided in accordance with the learning content of the national curriculum standards: Morality and Law, Chinese Language, History, Geography, Mathematics, foreign languages (English, Japanese, and Russian), Physics, Chemistry and Biology. The Notice also states that sports (or sports and health), art (or music, fine arts) subjects, and comprehensive practical activities (including technical education, labor and technical education), etc. shall be managed as non-academic subjects.

On August 14, 2021, Beijing Municipality Government and Beijing Municipal Committee of the Communist Party of China jointly issued “Beijing Municipality’s Measures to Further Reduce the Burden of Homework and After-School Tutoring on Students in Compulsory Education in Beijing” (“Beijing Measures”). Beijing Measures were adopted to implement the Opinion and aims to ensure that “the excessive burden upon students from school homework and after-school tutoring, the education expenditures from their families and the burden on their parents’ energy will be effectively reduced by the end of 2021, with significant impact achieved within two years.” On August 24, 2021, Shanghai local government issued the “Measures to Further Alleviate the Burden of Homework and After-School Tutoring on Students in Compulsory Education” and answers to twelve questions related to such measures (collectively, “Shanghai Measures”). Shanghai Measures were adopted to implement the Opinion and aim to, within one year, “(i) effectively control the volume of, and the amount of time it takes to complete, homework assigned to students during the compulsory education stage, (ii) ensure all compulsory education schools provide on-campus, after-school services, (iii) complete the rectification of business practices of online and offline providers of after-school tutoring services on academic subjects in China’s compulsory education system, (iv) effectively reduce the excessive burden upon students from school homework and after-school tutoring, the education expenditures from their families and the burden on their parents’ energy.” Certain other provinces and municipalities in China have also adopted similar measures to implement the Opinion and the Company expects that additional provinces and municipalities may follow similar approaches.

The Company’s Business

The Company currently provides a wide variety of creative arts related international educational services to its students, including the following:

|

|

1. |

Portfolio Training Services. Overseas art universities and colleges typically require a practical art portfolio as part of the application process, which is a collection of art work that shows how a candidate’s skills and ideas have developed over a period of time and helps universities and colleges evaluate the candidate’s potential. The Company |

October 15, 2021 - Page 3

|

|

provides customized and systematic portfolio training services to its students to help them prepare their portfolios. |

|

|

2. |

Research-Based Learning Services. The Company’s research-based learning services include overseas educational travel services, domestic educational travel services and other offline and online research-based learning services to students, mainly including art related academic educational learning, workshop experience, themed educational travel and transferrable credit courses. |

|

|

3. |

Overseas Study Counselling Services. The Company offers art-related overseas study counselling services, including counselling advice on background development, university and program selection, paper writing, interview simulation, application preparation, etc. to help students apply for overseas art universities and colleges. |

|

|

4. |

Other Educational Services. Mainly including (i) foreign language training services, including English, German, French, Spanish, Italian and Japanese, provided to students who need to take language tests when applying for overseas universities or students interested in learning foreign languages; (ii) junior art education services, mainly painting courses, provided to junior students from age 3 to 12; and (iii) in-school art classes provided to students in the Company’s partner international schools. |

|

|

5. |

K-12 Education Assessment and Other Services. Mainly including the legacy K-12 education assessment services where the Company evaluates the learning competencies of students and teaching qualities of K-12 schools; and the Company’s research project with the Research Institute of Future Education and Assessment of Tsinghua University which focuses on the assessments of Chinese skills and competencies of non-native Chinese learners. The Company sold the legacy business of K-12 education assessment services in June 2021, which will enable the Company to focus its efforts on growing its core international education services business. |

Based on the Company’s understanding of the Opinion, the Notice and relevant local implementing measures for the Opinion, the Company’s major business, including portfolio training services and other art related services, is not academic subjects tutoring for students in compulsory education, and thus is not subject to the Opinion, the Notice and relevant local implementing measures. Two types of the Company’s ancillary services, however, may fall under the coverage of the Opinion and its local implementing measures, including (i) some art related academic educational learning services and transferrable credit courses carried out by foreign teachers residing overseas, which together only constitute a very small portion of the Company’s business operations and contributed around 1.2% of the Company’s net revenues for the fiscal year ended December 31, 2020; and (ii) the Company’s foreign language training services for English and Japanese offered to senior high school students, which also only constitute a very small portion of the Company’s business operations and contributed less than 2% of the Company’s net revenues for the fiscal year ended December 31, 2020. With respect to (i), although the Opinion states that after-school tutoring institutions shall not engage foreign teachers residing overseas to carry out training activities and does not specifically limit this restriction to Academic AST Institutions, the Opinion itself is focused on regulating Academic AST Institutions, therefore, it is unclear whether the Company’s services will fall under such restriction. With respect to (ii), as the Notice only states that English and Japanese language tutoring that is provided in accordance with the learning content of the national curriculum standards shall

October 15, 2021 - Page 4

be regulated as academic subjects, and the Company’s services focus on training students for taking language tests for overseas university applications, it is unclear whether such services will be categorized as academic subjects. As of the date hereof, the Company has not received any notifications for rectification or administrative measure which requires it to rectify any of its business in accordance with the Opinion. Overall, the Company does not believe the Opinion and the relevant regulations would have a material adverse impact on its business. The Company is closely monitoring the evolving regulatory environment and is making efforts to seek guidance from and cooperate with the government authorities to comply with the Opinion, and if there is no other available option, the Company may elect to change the business model of or dispose of the foregoing art training services carried out by foreign teachers and foreign language training services to ensure compliance.

Although currently the Company does not believe the Opinion and relevant regulations would have a material adverse impact on its business, since these regulations and policies are relatively new and the related regulatory regime continues to rapidly evolve, the interpretations of these regulations and rules are not always uniform, and the enforcement of these regulations and rules involve uncertainties, the Company cannot assure you that any future development, interpretation and enforcement of Opinion and relevant regulations would not materially and adversely impact its business and financial outlook.

Form 20-F for the Fiscal Year Ended December 31, 2020

Item 3. Key Information, page 3

|

2. |

Please disclose prominently here that you are not a Chinese operating company but a Cayman Islands holding company with operations conducted by your subsidiaries and through contractual arrangements with a variable interest entity (VIE) based in China and that this structure involves unique risks to investors. Explain whether the VIE structure is used to replicate foreign investment in Chinese-based companies where Chinese law prohibits direct foreign investment in the operating companies, and disclose that investors may never directly hold equity interests in the Chinese operating company. Your disclosure should acknowledge that Chinese regulatory authorities could disallow this structure, which would likely result in a material change in your operations and/or value of your ADSs, including that it could cause the value of such securities to significantly decline or become worthless. Provide a cross-reference to your detailed discussion of risks facing the company and any future offering as a result of this structure. |

The Company respectfully advises the Staff that the Company will make the following disclosure in this section in its annual report to be filed on Form 20-F for the fiscal year 2021 (the “2021 Form 20-F”), with necessary updates based on the changes of facts or regulations by then, if any:

The Company is a Cayman Islands holding company with operations conducted by our subsidiaries and through contractual arrangements with ATA Intelligent Learning (Beijing) Technology Limited, or the VIE, a variable interest entity based in China. Our primary business operations, including our portfolio training business, research-based learning services, overseas study counselling services and other educational services, are conducted by our PRC subsidiary HQYM and its subsidiaries. 69.0417% of the equity interests of HQYM is indirectly owned by the Company through a wholly owned BVI holding company, and 30.9583% equity interests of HQYM is owned by the VIE. Currently, the VIE also

October 15, 2021 - Page 5

holds 70% equity interests in Beijing Zhenwu Technology Development Co., Ltd., or Beijing Zhenwu, a PRC company newly established in August 2021. Beijing Zhenwu is mainly engaged in conducting some of our project-based learning services, primarily including short-term art courses. Other than holding 30.9583% equity interests in HQYM and 70% equity interests in Beijing Zhenwu, the VIE also holds certain minority investment in two other PRC companies. As of the date hereof, the VIE is not engaged in any business operations itself. Notwithstanding the foregoing, as we are currently expanding our online courses and other services, for which an internet content provision license, or ICP license, may be required under PRC law, we may elect to provide such services through the VIE in the future if and to the extent that an ICP license or any other license or permission not available for foreign-invested companies is required. See “Item 3.D. Risk Factors — Risks Relating to Doing Business in the People’s Republic of China — Our ability to provide our creative arts related international educational services may be subject to significant limitations or may otherwise be materially and adversely affected by changes in PRC laws and regulations.” VIE structure is a structure commonly used to replicate foreign investment in Chinese-based companies such as the VIE where Chinese law prohibits direct foreign investment in the operating companies, and investors may never be able to directly hold equity interests in the VIE. In addition, PRC regulatory authorities could disallow our VIE structure, which may result in a material change in our operations and/or value of our ADSs, including that it could cause the value of our ADSs to significantly decline or become worthless. See “Item 3.D. Risk Factors — Risks Relating to our Corporate Structure.”

|

3. |

Provide prominent disclosure about the legal and operational risks associated with being based in or having the majority of the company’s operations in China. Your disclosure should make clear whether these risks could result in a material change in your operations and/or the value of your ADSs or could significantly limit or completely hinder your ability to continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. Your disclosure should address how recent statements and regulatory actions by China’s government, such as those related to the use of variable interest entities and data security or anti-monopoly concerns, has or may impact the company’s ability to conduct its business, accept foreign investments, or list on an U.S. or other foreign exchange. |

The Company respectfully advises the Staff that the Company will make the following disclosure in this section in its 2021 Form 20-F, with necessary updates based on the changes of facts or regulations by then, if any:

We and the VIE operate our business primarily in China and are subject to complex and evolving PRC laws and regulations. Uncertainties in the PRC legal system and the interpretation and enforcement of PRC laws and regulations could limit the legal protection available to you and us, hinder our ability to offer our ADSs in the future, result in a material adverse effect on our business operations, and damage our reputation, which might further cause our ADSs to significantly decline in value or become worthless. See “Item 3.D. Risk Factors — Risks Relating to Doing Business in the People’s Republic of China.”

Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly

October 15, 2021 - Page 6

enforcement. As of the date hereof, we do not expect these recent statements and regulatory actions would materially impact our and the VIE’s ability to conduct our business, accept foreign investments or continue to list on a U.S exchange. However, since these statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact such modified or new laws and regulations may have on our daily business operations, the ability to accept foreign investments and continue to list on a U.S. exchange. See “Item 3.D. Risk Factors — Risks Relating to Regulations of Our Business” and “Item 3.D. Risk Factors — Risks Relating to Doing Business in the People’s Republic of China.”

The Company respectfully advises the Staff that the Company will clearly differentiate the references when referring to the holding company, its subsidiaries and the VIE when providing the disclosure throughout its 2021 Form 20-F so that investors are clear on which entity the disclosure is referencing and which subsidiaries or entities are conducting the business operations. In such disclosure, the Company will not use “we” or “our” to describe activities or functions of the VIE and will also clarify that investors may never be able to directly hold equity interests in the VIE.

|

5. |

Disclose clearly here that the company uses a structure that involves a VIE based in China and what that entails and provide a diagram of the company’s corporate structure, including what the equity ownership interests are of each entity. Describe all contracts and arrangements through which you purport to obtain economic rights and exercise control that results in consolidation of the VIE’s operations and financial results into your financial statements. Identify clearly the entity in which investors have or can purchase their interest in and the entity(ies) in which the company’s operations are conducted. Describe the relevant contractual agreements between the entities and how this type of corporate structure may affect investors and the value of their investment, including how and why the contractual arrangements may be less effective than direct ownership and that the company may incur substantial costs to enforce the terms of the arrangements. Disclose the uncertainties regarding the status of the rights of the Cayman Islands holding company with respect to its contractual arrangements with the VIE, its founders and owners, and the challenges the company may face enforcing these contractual agreements due to uncertainties under Chinese law and jurisdictional limits. |

The Company respectfully advises the Staff that the Company will make the following disclosure in this section in its 2021 Form 20-F, with necessary updates based on the changes of facts or regulations by then, if any:

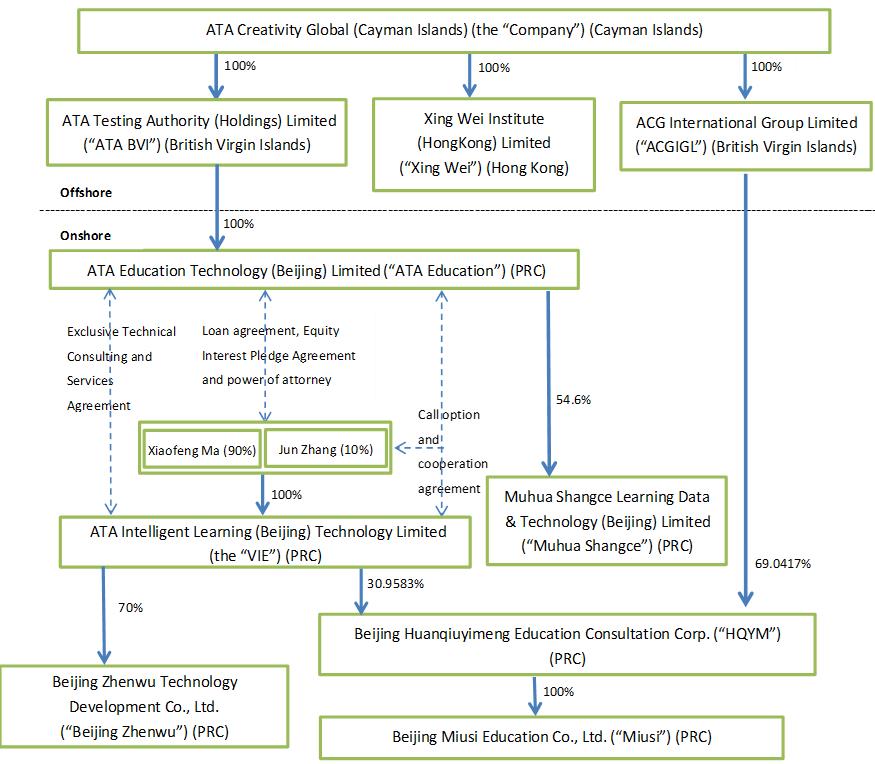

As disclosed above, we are a Cayman Islands holding company with operations conducted in China by (i) our subsidiaries in which we hold equity ownership interests, and (ii) the VIE and its subsidiary. We, through our subsidiaries, control the VIE through a series of

October 15, 2021 - Page 7

contractual arrangements with the VIE and its shareholders, including (i) Equity Interest Pledge Agreements and Powers of Attorney that provide us with effective control over the VIE; (ii) Exclusive Technical Consulting and Services Agreement that allow us to receive economic benefits from the VIE; and (iii) Call Option and Cooperation Agreement and Loan Agreements that provide us with the option to purchase the equity interest in the VIE. These contractual arrangements allow us to exercise control over the VIE and thus result in consolidation of the VIE’s operations and financial results into our financial statements. See “Item 4.A. History and Development of the Company — Our Consolidated Variable Interest Entity” and “Item 4.A History and Development of the Company — Contractual Arrangements with ATA Intelligent Learning.” However, control through these contractual arrangements may be less effective than direct ownership as the VIE’s shareholders may fail to perform their obligations under the contractual arrangements and we could incur substantial costs in enforcing these contractual arrangements if we are able to enforce these contractual arrangements at all. In addition, there are substantial uncertainties regarding the interpretation and application of current and future PRC laws, regulations, and rules relating to such contractual arrangements, including potential future actions by the PRC government, which could affect the enforceability of our contractual arrangements with the VIE, and consequently, significantly affect our financial condition and results of operations. If the PRC government finds such agreements non-compliant with relevant PRC laws, regulations, and rules, we could be subject to severe penalties or be forced to relinquish our interests in the VIE or forfeit our rights under the contractual arrangements. See “Item 3.D. Risk Factors — Risks Relating to our Corporate Structure.”

The following diagram illustrates the corporate structure of us and the VIE as of the date hereof:

October 15, 2021 - Page 8

|

6. |

In your summary of risk factors, disclose the risks that your corporate structure and being based in or having the majority of the company’s operations in China poses to investors. In particular, describe the significant regulatory, liquidity, and enforcement risks. For example, specifically discuss risks arising from the legal system in China, including risks and uncertainties regarding the enforcement of laws and that rules and regulations in China can change quickly with little advance notice; and the risk that the Chinese government may intervene or influence your operations at any time, or may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers, which could result in a material change in your operations and/or the value of your ADSs. Acknowledge any risks that any actions by the Chinese government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers could significantly limit or completely hinder your ability to continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. |

The Company respectfully advises the Staff that the Company will include the following risk factors in the summary of risk factors section in its 2021 Form 20-F, with necessary updates based on the changes of facts or regulations by then, if any:

|

|

• |

We are a Cayman Islands holding company primarily operating in China through our subsidiaries and contractual arrangements with the VIE. Investors purchasing our ADSs are not purchasing, and may never directly hold, equity interests in the |

October 15, 2021 - Page 9

|

|

VIE. There are substantial uncertainties regarding the interpretation and application of current and future PRC laws, regulations, and rules relating to such agreements, including potential future actions by the PRC government, which could affect the enforceability of our contractual arrangements with the VIE, and consequently, significantly affect our financial condition and results of operations. |

|

|

• |

We rely on contractual arrangements with the VIE and its shareholders for our operations in China, which may not be as effective in providing operational control as direct ownership, and the VIE’s shareholders may fail to perform their obligations under the contractual arrangements. |

|

|

• |

The shareholders of the VIE may have conflicts of interest with us, which may materially and adversely affect our and the VIE’s business. The shareholders of our VIE may breach, or cause our VIE to breach, or refuse to renew, the existing contractual arrangements we have with them and our VIE, which would have a material adverse effect on our ability to effectively control our VIE and receive economic benefits from them. If we cannot resolve any conflict of interest or dispute between us and these shareholders, we would have to rely on legal proceedings, which could result in disruption of our business and subject us to substantial uncertainty as to the outcome of any such legal proceedings. |

|

|

• |

China’s economic, political and social conditions, as well as changes in any government policies, laws and regulations, could adversely affect the overall economy in China or the prospects of the industries in which we and the VIE operate, which in turn could impact our financial performance. |

|

|

• |

The PRC legal system has inherent uncertainties that could limit the legal protections available to you and us, and rules and regulations in China can change quickly with little advance notice. |

|

|

• |

PRC government may exert substantial influence over our and the VIE’s operations, and may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers like us and the VIE, and any actions by Chinese government, including any decision to intervene or influence our operations or to exert control over any offering of securities conducted overseas and/or foreign investment in China-based issuers, may cause us and the VIE to make material changes to our operation, may limit or completely hinder our ability to offer or continue to offer securities to investors, and may cause the value of such securities to significantly decline or be worthless. |

|

7. |

Disclose each permission that you, your subsidiaries or your VIEs are required to obtain from Chinese authorities to operate and issue securities to foreign investors. State whether you, your subsidiaries, or VIEs are covered by permissions requirements from the CSRC, CAC or any other entity that is required to approve of the VIE’s operations, and state affirmatively whether you have received all requisite permissions and whether any permissions have been denied. |

The Company respectfully advises the Staff that the Company will make the following disclosure in this section in its 2021 Form 20-F, with necessary updates based on the changes of facts or regulations by then, if any:

October 15, 2021 - Page 10

As of the date hereof, we believe that our PRC subsidiaries and the VIE have obtained the requisite licenses and permits from the PRC government authorities that are material for the business operations of us and the VIE in the PRC, mainly including the ICP license obtained by the VIE, and no permissions have been denied. However, as PRC laws and regulations with respect to certain licenses and permissions are unclear and are subject to interpretations and enforcement of local governmental authorities, we and the VIE may be required to obtain additional licenses. For example, according to the Law for Promoting Private Education and the Amended Implementation Rules for the Law for Promoting Private Education newly promulgated by the State Council on April 7, 2021, or the Amended Implementation Rules, which became effective since September 1, 2021, private schools are required to obtain operating permits from relevant PRC authorities for carrying out educational activities. Although the Law for Promoting Private Education generally states that private education institutions are also included in the category of “private schools”, as of the date hereof, relevant implementing rules only require private education institutions providing tutoring services on academic subjects for K-12 students and certain vocational skill education services to obtain private school operating permits, and there is no implementing rules that require private education institutions focusing on art or other non-academic cultural education to obtain private school operating permits. To date, the Company and the VIE have not received any notifications for rectification or administrative measure which requires us and the VIE to obtain private school operating permits. However, since related regulatory regime of education industry in the PRC continues to rapidly evolve, the interpretations of relevant regulations and rules are not always uniform, and the enforcement of relevant regulations and rules involve uncertainties, we cannot assure you that our training centers will not be classified as a “private school” and thus be required to obtain private school operating permits by the regulators due to any future and further development, interpretation and enforcement of relevant regulations and rules. To date, only one of our training centers in Qingdao has obtained private school operating permit. See “Item 3.D. Risk Factors — Risks Relating to Doing Business in the People’s Republic of China — Our ability to provide our creative arts related international educational services may be subject to significant limitations or may otherwise be materially and adversely affected by changes in PRC laws and regulations.”

On July 6, 2021, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued the Opinions on Severe and Lawful Crackdown on Illegal Securities Activities, or the Crackdown Opinions. The Crackdown Opinions emphasized the need to strengthen the administration over illegal securities activities and the supervision on overseas listings by China-based companies. The Crackdown Opinions proposed to take effective measures, such as promoting the construction of relevant regulatory systems, to deal with the risks and incidents facing China-based overseas-listed companies and the demand for cybersecurity and data privacy protection. As of the date hereof, we believe the permission and approval of the China Securities Regulatory Commission, or CSRC, is not required for our and the VIE’s operations, but as the Crackdown Opinions were recently issued, official guidance and interpretation of the opinions remain unclear in several respects at this time, we cannot assure you that we and the VIE will remain fully compliant with all new regulatory requirements of the Crackdown Opinions or any future implementation rules on a timely basis, or at all.

October 15, 2021 - Page 11

Moreover, the Cyberspace Administration of China, or the CAC, publicly issued the Measures of Cybersecurity Review (Revised Draft for Comments, not yet effective) on July 10, 2021, or the Draft Measures for Cybersecurity Review, which requires operators with personal information of more than 1 million users who want to list abroad to file a cybersecurity review with the CAC. We do not expect to be subject to cybersecurity review with the CAC, if the Draft Measures for Cybersecurity Review become effective as they are published, since we do not possess a large amount of personal information in our and the VIE’s business operations and data processed in our and the VIE’s business does not have a bearing on national security and thus may not be classified as core or important data by the authorities. However, there remains uncertainty as to how the Draft Measures for Cybersecurity Review will be interpreted or implemented and whether the PRC regulatory agencies, including the CAC, may adopt new laws, regulations, rules, or detailed implementation and interpretation related to the Draft Measures for Cybersecurity Review.

The Company respectfully advises the Staff that the Company will include the following disclosures in this section in its 2021 Form 20-F with necessary updates based on the changes of facts or regulations by then, if any.

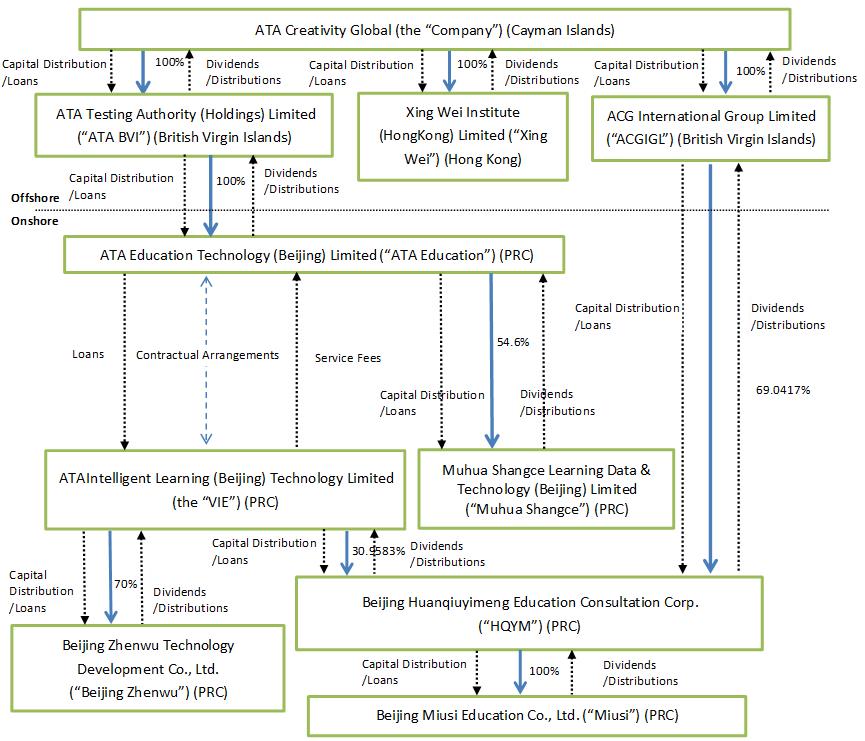

(a)Description of how cash is transferred through our organization

We have adopted a holding company structure, and our holding companies may rely on dividends and other distributions on equity paid by our current and future PRC subsidiaries or cash paid by our VIE under the VIE arrangement for their cash requirements, including the funds necessary to service any debt we may incur or financing we may need for operations not carried through our PRC subsidiaries or the VIE.

The Company may transfer funds to ATA BVI, Xing Wei and ACGIGL through capital contribution into or a shareholder loan to such subsidiaries respectively. ATA BVI and ACGIGL may transfer funds to ATA Education and HQYM through capital contribution into or a shareholder loan to ATA Education and HQYM respectively. ATA Education and HQYM may transfer funds to their respective subsidiaries through capital contribution into or a shareholder loan to them. ATA Education provides comprehensive business support, technical services, consultancy, etc. in exchange for service fees from the VIE. ATA Education may also provide loans to the VIE, subject to statutory limits and restrictions. In addition, the VIE may also receive dividends from its subsidiaries or investing companies, including HQYM, Beijing Zhenwu, etc.

October 15, 2021 - Page 12

The following diagram illustrates the typical fund flow through our organization (including the VIE).

(b)Cash flow and assets transfer between the Company, its subsidiaries, and the VIE

The cash inflows of the Company for the year ended December 31, 2018 were primarily received from the earnings distributed from its subsidiaries amounting to US$55.0 million and cash consideration of US$102.0 million in connection with the ATA Online Sale Transaction, among which US$137.7 million was paid to the Company’s investors as dividends with the rest being remained in the Company to support its operations. For the years ended December 31, 2019 and 2020, the Company received cash inflows of US$8.9 million and US$1.2 million in December 2019 and April 2020 respectively from new investors through a private placement.

Cash is transferred from the Company to its subsidiaries through shareholder loan and capital contribution. For the year ended December 31, 2019, a subsidiary of the Company (ATA BVI) provided a loan of US$2.0 million to its subsidiaries in December 2019. For the year ended December 31, 2020, a subsidiary of the holding companies (ATA BVI) made capital contribution of US$5.0 million to its subsidiaries in March 2020. These cash flows were classified as investing activities of the Company and financing activities of the Company’s subsidiaries, respectively.

October 15, 2021 - Page 13

To date, we and the VIE have not distributed any earnings or settled any amounts owed under the VIE agreements. We and the VIE do not currently have any plans to distribute earnings or settle amounts owed under the VIE agreements.

For the years ended December 31, 2018, 2019 and 2020, due to the fact that the VIE did not provide material services, the VIE did not generate material cash inflows from the delivery of services, and its cash inflows were primarily generated via loan arrangement from subsidiaries of the Company. For the years ended December 31, 2018, 2019 and 2020, the VIE borrowed RMB28.0 million, which was repaid in full in 2019, RMB42.0 million and RMB15.1 million from subsidiaries of the Company respectively. As of December 31, 2020, the outstanding payables due to subsidiaries of the Company was RMB57.1 million and was eliminated during the consolidation process. These cash flows are classified as the Company’s subsidiaries investing activities and financing activities of the VIE, respectively.

For the year ended December 31, 2018, a subsidiary (ATA Education) of the Company transferred its long-term investment in Beijing GlobalWisdom Information Technology Co., Ltd (“GlobalWisdom”) to the VIE for a consideration of RMB12.45 million and the VIE transferred cash consideration to ATA Education in the amount of RMB12.45 million.

A Subsidiary of the Company (ATA Education) has provided loans of RMB0.9 million and RMB0.1 million to Mr. Xiaofeng Ma (Chairman and CEO of the Company) and Mr. Haichang Xiong (former General Legal Counsel of the Company), nominee shareholders of the VIE, as initial capital contribution into the VIE in April 2018, respectively. In December 2018, ATA Education provided additional loans of RMB8.1 million and RMB0.9 million to Mr. Xiaofeng Ma and Mr. Haichang Xiong as capital contribution into the VIE, respectively. In April and June 2019, ATA Education provided additional loans in total of RMB36.0 million and RMB4.0 million to Mr. Xiaofeng Ma and Mr. Haichang Xiong as another round of capital contribution into the VIE, respectively. In August 2020, the prior nominee shareholder Mr. Haichang Xiong transferred its 10% equity shares in the VIE to Mr. Jun Zhang (President and Director of the Company) and paid back the entire RMB5.0 million loan to ATA Education. ATA Education provided a loan in RMB5.0 million to Mr. Jun Zhang to acquire the 10% equity interests of the VIE. These cash flows are classified as the related subsidiaries’ investing activities and financing activities of the VIE, respectively. As of December 31, 2020, receivables due from Mr. Xiaofeng Ma and Mr. Jun Zhang in the balance of RMB 45.0 million and RMB 5.0 million respectively were recorded as the receivables due from related parties for VIE.

Other than the above, no assets were transferred among the Company, its subsidiaries, and the VIE for the years ended December 31, 2018, 2019 and 2020.

(c)Dividends or distributions made to the Company and tax consequences thereof

In connection with the ATA Online Sale Transaction, the Company’s former wholly owned subsidiary of ATA Learning has distributed a total of RMB261.6 million dividend to the Company through ATA BVI in July 2018. The dividends were mainly paid out of the proceeds received from the sale of the ATA Online Business. According to relevant PRC tax rules, 10% withholding tax was imposed on any dividends or distributions made across border outbound for PRC entities. Therefore, RMB26.2 million withholding tax in relation to this dividend distribution was paid to tax authority in China. The Company’s wholly owned Hong Kong subsidiary Xing Wei has distributed a total of US$18.3 million to the

October 15, 2021 - Page 14

Company in August 2018. The dividends were mainly paid out of the proceeds Xing Wei received from the sale of the ATA Online Business. No taxes were imposed for such distribution of earnings per laws of Hong Kong.

Other than the foregoing, to date, the Company’s current subsidiaries and the VIE have not made any dividends or distributions to the Company for the fiscal years ended 2018, 2019 and 2020. If any dividend is paid by our PRC subsidiaries to the Company in the future, under China’s EIT Law and its Implementation Rules, dividends from our PRC subsidiaries to its non-PRC shareholders may be subject to a 10% withholding tax if such dividends are derived from profits. If the Company or its offshore subsidiaries are deemed to be a PRC resident enterprise (we do not currently consider the Company or its offshore subsidiaries to be PRC resident enterprises), the withholding tax may be exempted, but the Company or its offshore subsidiaries will be subject to a 25% tax on our worldwide income, and our non-PRC enterprise investors may be subject to PRC income tax withholding at a rate of 10%. See “Item 3.D. Risk Factors — Risks Relating to Regulations of Our Business — Under the EIT Law, we may be classified as a ‘resident enterprise’ of China. Such classification will likely result in unfavorable tax consequences to us and U.S. holders of our ADSs or common shares” and “Item 10.E. Taxation — People’s Republic of China Taxation.” If any payment is made from the VIE to ATA Education pursuant to the contractual arrangements between them, such payments will be subject to PRC taxes, including business taxes and VAT.

(d)Dividends or distributions made to the U.S. investors and tax consequences thereof

On August 8, 2018, the Company declared a special cash dividend of US$3.00 per common share, or US$6.00 per ADS in connection with the final closing of the sale of the ATA Online Business. The total amount of cash dividend distributed was approximately RMB 946.6 million, which was paid on August 24, 2018 out of the proceeds we received from the sale of the ATA Online Business to all shareholders of records as of the close of business on August 20, 2018. No taxes were imposed per laws and tax rules of Cayman Islands. US Investors who received the dividends will need to include the dividends in filing their tax returns respectively.

The Company has not made any dividends or distributions to its shareholders for the fiscal years ended 2018, 2019 and 2020 since August 8, 2018. Any future determination to pay dividends will be made at the discretion of our board of directors and will be based upon our future operations and earnings, capital requirements and surplus, general financial condition, shareholders’ interests, contractual restrictions and other factors our board of directors may deem relevant.

Under the current laws of Cayman Islands, no Cayman Islands withholding tax is imposed upon any payments of dividends by the Company. However, if the Company is considered a PRC tax resident enterprise for tax purposes (we do not currently consider the Company to be a PRC resident enterprise), any dividends that the Company pays to its overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding tax. See “Item 3.D.— Risk Factors — Risks Relating to Regulations of Our Business — Under the EIT Law, we may be classified as a ‘resident enterprise’ of China. Such classification will likely result in unfavorable tax consequences to us and U.S. holders of our ADSs or common shares” and “Item 10.E. Taxation — People’s Republic of China Taxation.”

October 15, 2021 - Page 15

In addition, subject to the passive foreign investment company rules, the gross amount of any distribution that the Company makes to investors with respect to our ADSs or common shares (including any amounts withheld to reflect PRC withholding taxes) will be taxable as a dividend, to the extent paid out of our current or accumulated earnings and profits, as determined under United States federal income tax principles.

(e) Restrictions on foreign exchange and our ability to transfer cash between entities, across borders, and to U.S. investors. Restrictions and limitations on our ability to distribute earnings from our businesses

We are a Cayman Islands holding company with operations conducted by our subsidiaries and through contractual arrangements with the VIE based in China. As a result, although other means are available for us to obtain financing at the Company level, the Company’s ability to pay dividends to its shareholders and to service any debt it may incur may depend upon dividends paid by our PRC subsidiaries and license and service fees paid by the VIE. If any of our PRC subsidiaries or the VIE incurs debt on its own in the future, the instruments governing such debt may restrict its ability to pay dividends to the Company. If any of our PRC subsidiaries or the VIE is unable to receive all or majority of the revenues from our and the VIE’s operations, we may be unable to pay dividends on our ADSs or common shares.

The PRC government also imposes controls on the convertibility of Renminbi into foreign currencies and, in certain cases, the remittance of currency out of China. The majority of our revenue is or will be received in Renminbi and shortages in foreign currencies may restrict our ability to pay dividends or other payments. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from trade-related transactions, can be made in foreign currencies without prior approval from SAFE as long as certain procedural requirements are met. Approval from appropriate government authorities is required if Renminbi is converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC government may, at its discretion, impose restrictions on access to foreign currencies for current account transactions and if this occurs in the future, we may not be able to pay dividends in foreign currencies to our shareholders or repay our loans.

Also, PRC legal restrictions permit payments of dividends by our PRC subsidiaries only out of their accumulated after-tax profits, if any, determined in accordance with PRC GAAP. Each of our PRC subsidiaries is also required under PRC laws and regulations to allocate at least 10% of its after-tax profits determined in accordance with PRC GAAP to statutory reserves until such reserves reach 50% of its registered capital. Allocations to these statutory reserves and funds can only be used for specific purposes and are not transferable to us in the form of loans, advances or cash dividends. In addition, registered share capital and capital reserve accounts are also restricted from withdrawal in the PRC, up to the amount of net assets held in each operating subsidiary. See “Item 3.D. Risk factors - Risks Relating to Regulations of Our Business - Because we may rely on dividends and other distributions on equity paid by our current and future PRC subsidiaries for our cash requirements, restrictions under PRC law on their ability to make such payments could materially and adversely affect our ability to grow, make investments or acquisitions that

October 15, 2021 - Page 16

could benefit our business, pay dividends to you, and otherwise fund and conduct our businesses.”

In addition, there are substantial uncertainties regarding the interpretation and application of current and future PRC laws, regulations and rules relating to VIE agreements, and the VIE agreements with the VIE and its shareholders may not be as effective as direct ownership in providing us with control over the VIE. The uncertainty with respect to the validity and enforceability of the VIE agreements may limit our ability to settle amounts owed under the VIE agreements. See “Item 3.D. Risk factors — Risks Relating to Our Corporate Structure.

October 15, 2021 - Page 17

|

9. |

We note that the VIEs constitute a material part of your consolidated financial statements. Please provide in tabular form condensed consolidating schedules - depicting the financial position, cash flows and results of operations for the parent, the consolidated variable interest entities, and any eliminating adjustments separately - as of the same dates and for the same periods for which audited consolidated financial statements are required. Highlight the financial statement information related to the variable interest entity and parent, so an investor may evaluate the nature of assets held by, and the operations of, entities apart from the variable interest entity, which includes the cash held and transferred among entities. |

The Company respectfully advises the Staff that the following tables present the Company’s condensed consolidating schedule depicting the consolidated statements of comprehensive income (loss) for the fiscal years ended December 31, 2018, 2019 and 2020 of the Company, its subsidiaries, the VIE and the corresponding eliminating adjustments separately.

|

|

Year Ended December 31, |

||||||||

|

|

2020 |

||||||||

|

|

The Company |

|

Subsidiaries of the Company |

|

VIE |

|

Elimination adjustments |

|

Consolidated |

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

Net revenues |

— |

|

162,167,547 |

|

— |

|

— |

|

162,167,547 |

|

Cost and expenses: |

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

— |

|

98,521,027 |

|

— |

|

— |

|

98,521,027 |

|

Impairment loss of intangible assets and other non-current assets |

— |

|

3,120,425 |

|

— |

|

— |

|

3,120,425 |

|

Provision for loan receivable and other receivables |

3,943,902 |

|

1,960,403 |

|

— |

|

— |

|

5,904,305 |

|

Operating expenses |

10,748,782 |

|

151,212,911 |

|

468,695 |

|

— |

|

162,430,388 |

|

Total cost and expenses |

14,692,684 |

|

254,814,766 |

|

468,695 |

|

— |

|

269,976,145 |

|

Other operating income, net |

— |

|

330,224 |

|

— |

|

— |

|

330,224 |

|

Loss from operations |

(14,692,684) |

|

(92,316,995) |

|

(468,695) |

|

— |

|

(107,478,374) |

|

Other income (loss) |

63,608 |

|

50,050 |

|

5,323 |

|

— |

|

118,981 |

|

Investment loss |

(83,753,528) |

|

(1,767,800) |

|

(13,840,830) |

|

97,594,358 |

(2) |

(1,767,800) |

|

Impairment loss of long-term investments |

— |

|

(1,726,391) |

|

— |

|

— |

|

(1,726,391) |

|

Loss from operations before income taxes |

(98,382,604) |

|

(95,761,136) |

|

(14,304,202) |

|

97,594,358 |

|

(110,853,584) |

|

Income tax benefit |

— |

|

(10,268,836) |

|

— |

|

— |

|

(10,268,836) |

|

Loss from operations, net of income taxes |

(98,382,604) |

|

(85,492,300) |

|

(14,304,202) |

|

97,594,358 |

|

(100,584,748) |

|

Net loss |

(98,382,604) |

|

(85,492,300) |

|

(14,304,202) |

|

97,594,358 |

|

(100,584,748) |

|

Net loss attributable to non-controlling interests |

— |

|

(22,227,546) |

|

— |

|

13,840,830 |

(2) |

(8,386,716) |

|

Net loss attributable to ATA Creativity Global |

(98,382,604) |

|

(63,264,754) |

|

(14,304,202) |

|

83,753,528 |

|

(92,198,032) |

October 15, 2021 - Page 18

|

|

Year Ended December 31, |

||||||||

|

|

2019 |

||||||||

|

|

The Company |

|

Subsidiaries of the Company |

|

VIE |

|

Elimination adjustments |

|

Consolidated |

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

Net revenues |

— |

|

97,770,167 |

|

— |

|

— |

|

97,770,167 |

|

Cost and expenses: |

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

— |

|

61,914,502 |

|

— |

|

— |

|

61,914,502 |

|

Impairment loss of intangible assets and other non-current assets |

— |

|

8,932,439 |

|

— |

|

— |

|

8,932,439 |

|

Provision for loan receivable and other receivables |

11,843,167 |

|

5,587,658 |

|

— |

|

— |

|

17,430,825 |

|

Operating expenses |

6,928,823 |

|

115,188,774 |

|

841,189 |

|

4,894,197 |

(1) |

127,852,983 |

|

Total cost and expenses |

18,771,990 |

|

191,623,373 |

|

841,189 |

|

4,894,197 |

|

216,130,749 |

|

Other operating income, net |

— |

|

588,147 |

|

— |

|

— |

|

588,147 |

|

Loss from continuing operations |

(18,771,990) |

|

(93,265,059) |

|

(841,189) |

|

(4,894,197) |

|

(117,772,435) |

|

Other income (loss) |

1,391,184 |

|

2,117,988 |

|

(175,995) |

|

— |

|

3,333,177 |

|

Investment loss |

(110,881,674) |

|

(7,850) |

|

(7,520,504) |

|

118,402,178 |

(2) |

(7,850) |

|

Impairment loss of long-term investments |

— |

|

(20,895,309) |

|

(5,919,198) |

|

— |

|

(26,814,507) |

|

Loss from continuing operations before income taxes |

(128,262,480) |

|

(112,050,230) |

|

(14,456,886) |

|

113,507,981 |

|

(141,261,615) |

|

Income tax benefit |

— |

|

(7,149,119) |

|

— |

|

— |

|

(7,149,119) |

|

Loss from continuing operations, net of income taxes |

(128,262,480) |

|

(104,901,111) |

|

(14,456,886) |

|

113,507,981 |

|

(134,112,496) |

|

Income from discontinued operations, net of income taxes |

— |

|

— |

|

— |

|

4,894,197 |

(1) |

4,894,197 |

|

Net loss |

(128,262,480) |

|

(104,901,111) |

|

(14,456,886) |

|

118,402,178 |

|

(129,218,299) |

|

Net loss attributable to non-controlling interests |

— |

|

(14,484,814) |

|

— |

|

7,520,504 |

(2) |

(6,964,310) |

|

Net loss attributable to ATA Creativity Global |

(128,262,480) |

|

(90,416,297) |

|

(14,456,886) |

|

110,881,674 |

|

(122,253,989) |

October 15, 2021 - Page 19

|

|

Year Ended December 31, |

||||||||

|

|

2018 |

||||||||

|

|

The Company |

|

Subsidiaries of the Company |

|

VIE |

|

Elimination adjustments |

|

Consolidated |

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

Net revenues |

— |

|

1,338,592 |

|

— |

|

— |

|

1,338,592 |

|

Cost and expenses: |

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

— |

|

4,251,451 |

|

— |

|

— |

|

4,251,451 |

|

Impairment loss of intangible assets and other non-current assets |

— |

|

— |

|

— |

|

— |

|

— |

|

Provision for loan receivable and other receivables |

— |

|

— |

|

— |

|

— |

|

— |

|

Operating expenses |

4,963,891 |

|

63,473,017 |

|

235,601 |

|

— |

|

68,672,509 |

|

Total cost and expenses |

4,963,891 |

|

67,724,468 |

|

235,601 |

|

— |

|

72,923,960 |

|

Other operating income, net |

— |

|

3,793,418 |

|

— |

|

— |

|

3,793,418 |

|

Loss from continuing operations |

(4,963,891) |

|

(62,592,458) |

|

(235,601) |

|

— |

|

(67,791,950) |

|

Other income (loss) |

1,021,983 |

|

2,706,674 |

|

(359,379) |

|

— |

|

3,369,278 |

|

Investment income (loss) |

852,782,280 |

|

150,000 |

|

(150,000) |

|

(852,782,280) |

(2) |

— |

|

Impairment loss of long-term investments |

— |

|

— |

|

(6,380,802) |

|

— |

|

(6,380,802) |

|

Change in fair value of long-term investments |

— |

|

2,750,000 |

|

— |

|

— |

|

2,750,000 |

|

Income (loss) from continuing operations before income taxes |

848,840,372 |

|

(56,985,784) |

|

(7,125,782) |

|

(852,782,280) |

|

(68,053,474) |

|

Income tax benefit |

— |

|

— |

|

— |

|

— |

|

— |

|

Income (loss) from continuing operations, net of income taxes |

848,840,372 |

|

(56,985,784) |

|

(7,125,782) |

|

(852,782,280) |

|

(68,053,474) |

|

Income from discontinued operations, net of income taxes |

— |

|

918,654,979 |

|

— |

|

— |

|

918,654,979 |

|

Net income (loss) |

848,840,372 |

|

861,669,195 |

|

(7,125,782) |

|

(852,782,280) |

|

850,601,505 |

|

Net loss attributable to non-controlling interests |

— |

|

(4,324,409) |

|

— |

|

— |

|

(4,324,409) |

|

Net income (loss) attributable to ATA Creativity Global |

848,840,372 |

|

865,993,604 |

|

(7,125,782) |

|

(852,782,280) |

|

854,925,914 |

|

|

(1) |

To reclassify the legal and consulting fee reimbursement from the buyer related to the disposal of discontinued operations, which was presented under “operating expenses” of the Company’s condensed statement of comprehensive income (loss) versus “gain from disposal of discontinued operations, net of income taxes” of the consolidated statement of comprehensive income (loss). |

October 15, 2021 - Page 20

|

|

(2) |

To eliminate the investment income or loss recognized in the Company derived from earnings or losses picked up from its subsidiaries and the retained earnings or accumulated deficit of the subsidiaries, as well as the investment loss recorded in the VIE with the net loss attributable to the VIE as non-controlling interests recorded in the subsidiaries of the Company. |

The Company respectfully advises the Staff that the following tables present the Company’s condensed consolidating schedule depicting the consolidated balance sheets as of December 31, 2019 and 2020 of the Company, its subsidiaries, the VIE and corresponding eliminating adjustments separately.

|

|

December 31, |

||||||||

|

|

2020 |

||||||||

|

|

The Company |

|

Subsidiaries of the Company |

|

VIE |

|

Elimination adjustments |

|

Consolidated |

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

2,486,636 |

|

110,145,679 |

|

91,118 |

|

— |

|

112,723,433 |

|

Receivables |

— |

|

2,245,194 |

|

— |

|

— |

|

2,245,194 |

|

Prepaid expenses and other current assets |

3,983 |

|

5,882,810 |

|

84,180 |

|

— |

|

5,970,973 |

|

Intercompany receivables |

— |

|

57,122,000 |

|

— |

|

(57,122,000) |

(1) |

— |

|

Amounts due from related parties for VIE |

— |

|

50,000,000 |

|

— |

|

(50,000,000) |

(2) |

— |

|

Total current assets |

2,490,619 |

|

225,395,683 |

|

175,298 |

|

(107,122,000) |

|

120,939,600 |

|

Non-current assets: |

|

|

|

|

|

|

|

|

|

|

Other non-current assets |

— |

|

215,917,712 |

|

8,757 |

|

— |

|

215,926,469 |

|

Goodwill |

— |

|

194,754,963 |

|

— |

|

— |

|

194,754,963 |

|

Long-term investments |

198,028,805 |

|

38,000,000 |

|

75,764,719 |

|

(267,793,524) |

(3) |

44,000,000 |

|

Total non-current assets |

198,028,805 |

|

448,672,675 |

|

75,773,476 |

|

(267,793,524) |

|

454,681,432 |

|

Total assets |

200,519,424 |

|

674,068,358 |

|

75,948,774 |

|

(374,915,524) |

|

575,621,032 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

|

Accrued expenses and other payables |

2,114,561 |

|

44,834,059 |

|

71,562 |

|

— |

|

47,020,182 |

|

Short-term loans |

— |

|

6,801,000 |

|

— |

|

— |

|

6,801,000 |

|

Payable for business acquisition |

— |

|

— |

|

4,642,082 |

|

— |

|

4,642,082 |

|

Deferred revenues and other current liabilities |

— |

|

216,420,299 |

|

— |

|

— |

|

216,420,299 |

|

Intercompany payables |

— |

|

— |

|

57,122,000 |

|

(57,122,000) |

(1) |

— |

|

Total current liabilities |

2,114,561 |

|

268,055,358 |

|

61,835,644 |

|

(57,122,000) |

|

274,883,563 |

October 15, 2021 - Page 21

|

Total non-current liabilities |

— |

|

52,991,237 |

|

— |

|

— |

|

52,991,237 |

|

Total liabilities |

2,114,561 |

|

321,046,595 |

|

61,835,644 |

|

(57,122,000) |

|

327,874,800 |

|

|

|

|

|

|

|

|

|

|

|

|

Mezzanine equity-redeemable non-controlling interests |

— |

|

48,498,368 |

|

— |

|

— |

|

48,498,368 |

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders' equity: |

|

|

|

|

|

|

|

|

|

|

Common shares |

4,716,675 |

|

— |

|

— |

|

— |

|

4,716,675 |

|

Paid-in capital |

— |

|

15,984,800 |

|

50,000,000 |

|

(65,984,800) |

(2) (3) |

— |

|

Treasury shares |

(11,625,924) |

|

— |

|

— |

|

— |

|

(11,625,924) |

|

Additional paid-in capital |

541,272,503 |

|

(121,460,091) |

|

— |

|

121,460,091 |

(3) |

541,272,503 |

|

Accumulated other comprehensive income (loss) |

(37,424,722) |

|

(20,210,953) |

|

— |

|

20,210,953 |

(3) |

(37,424,722) |

|

Retained earnings (accumulated deficits) |

(298,533,669) |

|

359,601,917 |

|

(35,886,870) |

|

(323,715,047) |

(3) |

(298,533,669) |

|

Non-redeemable non-controlling interests |

— |

|

70,607,722 |

|

— |

|

(69,764,721) |

(3) |

843,001 |

|

Total shareholders’ equity |

198,404,863 |

|

304,523,395 |

|

14,113,130 |

|

(317,793,524) |

|

199,247,864 |

|

Total liabilities, mezzanine equity and shareholders’ equity |

200,519,424 |

|

674,068,358 |

|

75,948,774 |

|

(374,915,524) |

|

575,621,032 |

|

|

December 31, |

||||||||

|

|

2019 |

||||||||

|

|

The Company |

|

Subsidiaries of the Company |

|

VIE |

|

Elimination adjustments |

|

Consolidated |

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

77,996,136 |

|

75,766,500 |

|

435,122 |

|

— |

|

154,197,758 |

|

Receivables |

12,657,433 |

|

214,591 |

|

— |

|

— |

|

12,872,024 |

|

Prepaid expenses and other current assets |

13,154 |

|

16,473,035 |

|

4,180 |

|

— |

|

16,490,369 |

|

Intercompany receivables |

— |

|

42,000,000 |

|

— |

|

(42,000,000) |

(1) |

— |

|

Amounts due from related parties for VIE |

— |

|

50,000,000 |

|

— |

|

(50,000,000) |

(2) |

— |

|

Total current assets |

90,666,723 |

|

184,454,126 |

|

439,302 |

|

(92,000,000) |

|

183,560,151 |

|

Non-current assets: |

|

|

|

|

|

|

|

|

|

|

Other non-current assets |

— |

|

246,309,934 |

|

14,562 |

|

— |

|

246,324,496 |

|

Goodwill |

— |

|

200,478,795 |

|

— |

|

— |

|

200,478,795 |

|

Long-term investments |

213,391,690 |

|

39,726,391 |

|

89,605,550 |

|

(296,997,240) |

(3) |

45,726,391 |

October 15, 2021 - Page 22

|

Total non-current assets |

213,391,690 |

|

486,515,120 |

|

89,620,112 |

|

(296,997,240) |

|

492,529,682 |

|

Total assets |

304,058,413 |

|

670,969,246 |

|

90,059,414 |

|

(388,997,240) |

|

676,089,833 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

|

Accrued expenses and other payables |

3,918,340 |

|

43,828,714 |

|

— |

|

— |

|

47,747,054 |

|

Short-term loans |

— |

|

4,991,000 |

|

— |

|

— |

|

4,991,000 |

|

Payable for business acquisition |

— |

|

— |

|

19,642,082 |

|

— |

|

19,642,082 |

|

Deferred revenues and other current liabilities |

— |

|

192,436,148 |

|

— |

|

— |

|

192,436,148 |

|

Intercompany payables |

— |

|

— |

|

42,000,000 |

|

(42,000,000) |

(1) |

— |

|

Total current liabilities |

3,918,340 |

|

241,255,862 |

|

61,642,082 |

|

(42,000,000) |

|

264,816,284 |

|

Total non-current liabilities |

— |

|

60,741,929 |

|

— |

|

— |

|

60,741,929 |

|

Total liabilities |

3,918,340 |

|

301,997,791 |

|

61,642,082 |

|

(42,000,000) |

|

325,558,213 |

|

|

|

|

|

|

|

|

|

|

|

|

Mezzanine equity-redeemable non-controlling interests |

— |

|

44,896,428 |

|

— |

|

— |

|

44,896,428 |

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders' equity: |

|

|

|

|

|

|

|

|

|

|

Common shares |

4,692,312 |

|

— |

|

— |

|

— |

|

4,692,312 |

|

Paid-in capital |

— |

|

15,984,800 |

|

50,000,000 |

|

(65,984,800) |

(2) (3) |

— |

|

Treasury shares |

(27,737,073) |

|

— |

|

— |

|

— |

|

(27,737,073) |

|

Additional paid-in capital |

560,814,066 |

|

(120,314,594) |

|

— |

|

120,314,594 |

(3) |

560,814,066 |

|

Accumulated other comprehensive income (loss) |

(37,478,167) |

|

32,337,721 |

|

— |

|

(32,337,721) |

(3) |

(37,478,167) |

|

Retained earnings (accumulated deficits) |

(200,151,065) |

|

306,966,431 |

|

(21,582,668) |

|

(285,383,763) |

(3) |

(200,151,065) |

|

Non-redeemable non-controlling interests |

— |

|

89,100,669 |

|

— |

|

(83,605,550) |

(3) |

5,495,119 |

|

Total shareholders’ equity |

300,140,073 |

|

324,075,027 |

|

28,417,332 |

|

(346,997,240) |

|

305,635,192 |

|

Total liabilities, mezzanine equity and shareholders’ equity |

304,058,413 |

|

670,969,246 |

|

90,059,414 |

|

(388,997,240) |

|

676,089,833 |

|

|

(1) |

To eliminate the amounts related to the loans provided by a subsidiary of the Company (ATA Education) to the VIE. |

|

|

(2) |

To eliminate the loans that a subsidiary of the Company (ATA Education) provided to Mr. Xiaofeng Ma and Mr. Jun Zhang as capital contribution (common shares) into the VIE. |

|

|

(3) |

To eliminate the Company’s equity pick-up from subsidiaries or the VIE under respective equity accounts with corresponding long-term investment balances of the subsidiaries or the VIE. |

October 15, 2021 - Page 23

The Company respectfully advises the Staff that the following tables present the Company’s condensed consolidating schedule depicting the consolidated cash flows for the fiscal years ended December 31, 2018, 2019 and 2020 of the Company, its subsidiaries, the VIE, and corresponding eliminating adjustments separately.

|

|

|

Year Ended December 31, |

||||||||

|

|

|

2020 |

||||||||

|

|

|

The Company |

|

Subsidiaries of the Company |

|

VIE |

|

Elimination adjustments |

|

Consolidated |

|

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

Net cash used in operating activities |

|

(10,150,979) |

|

(17,256,377) |

|

(466,004) |

|

— |

|

(27,873,360) |

|

Net cash used in investing activities |

|

(68,989,990) |

|

(19,212,428) |

|

(15,000,000) |

|

84,111,990 |

(1) |

(19,090,428) |

|

Net cash provided by financing activities |

|

4,527,401 |

|

70,766,183 |

|

15,122,000 |

|

(84,111,990) |

(1) |

6,303,594 |

|

Effect of foreign currency exchange rate changes on cash |

|

(895,932) |

|

81,801 |

|

— |

|

— |

|

(814,131) |

|

Net increase (decrease) in cash and cash equivalents |

|

(75,509,500) |

|

34,379,179 |

|

(344,004) |

|

— |

|

(41,474,325) |

|

Cash and cash equivalents at the beginning of the year |

|

77,996,136 |

|

75,766,500 |

|

435,122 |

|

— |

|

154,197,758 |

|

Cash and cash equivalents at the end of the year |

|

2,486,636 |

|

110,145,679 |

|

91,118 |

|

— |

|

112,723,433 |

|

|

|

Year Ended December 31, |

||||||||

|

|

|

2019 |

||||||||

|

|

|

The Company |

|

Subsidiaries of the Company |

|

VIE |

|

Elimination adjustments |

|

Consolidated |

|

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

Net cash used in operating activities |

|

(4,797,830) |

|

(51,637,369) |

|

(1,441,360) |

|

— |

|

(57,876,559) |

|

Net cash provided by (used in) investing activities |

|

4,894,197 |

|

(18,346,645) |

|

(77,492,873) |

|

54,000,000 |

(1) |

(36,945,321) |

|

Net cash provided by (used in) financing activities |

|

61,693,192 |

|

(4,126,723) |

|

54,000,000 |

|

(54,000,000) |