WRITER'S DIRECT DIAL

(852) 3551-8690

WRITER'S E-MAIL ADDRESS

ning.zhang@morganlewis.com

February 22, 2022

VIA EDGAR

Ms. Aamira Chaudhry

Mr. Lyn Shenk

Office of Trade & Services

Division of Corporation Finance

Securities and Exchange Commission

100 F Street, NE

Washington, D.C. 20549

|

|

Re: |

ATA Creativity Global |

|

|

|

Filed April 13, 2021 |

|

|

|

File No. 001-33910_ |

|

Ladies and Gentlemen:

On behalf of ATA Creativity Global (the “Company”), set forth below are the Company’s responses to your comment letter dated February 3, 2022 (the “Letter”) with respect to the above-referenced Form 20-F (the “2020 Form 20-F”) filed with the Securities and Exchange Commission (the “Commission”) on April 13, 2021.

For your convenience, we have reproduced the comments from the Commission’s staff (the “Staff”) in bold and Italic in front of the related response. All references in the Company’s responses to pages and captioned sections are to the 2020 Form 20-F. Capitalized terms used in this letter and not otherwise defined herein have the meaning ascribed to them

in the 2020 Form 20-F and our October 15, 2021 response to your September 23, 2021 comment letter.

Form 20-F for the Fiscal Year Ended December 31, 2020

Item 3. Key Information, page 3

|

1. |

We note your response to comment number 5. However, it appears that you have only partially addressed our comment, accordingly we reissue our comment in part. Please revise to identify clearly the entity in which investors have or can purchase their interest in and the entity(ies) in which the company’s operations are conducted with the Corporate Structure Diagram. |

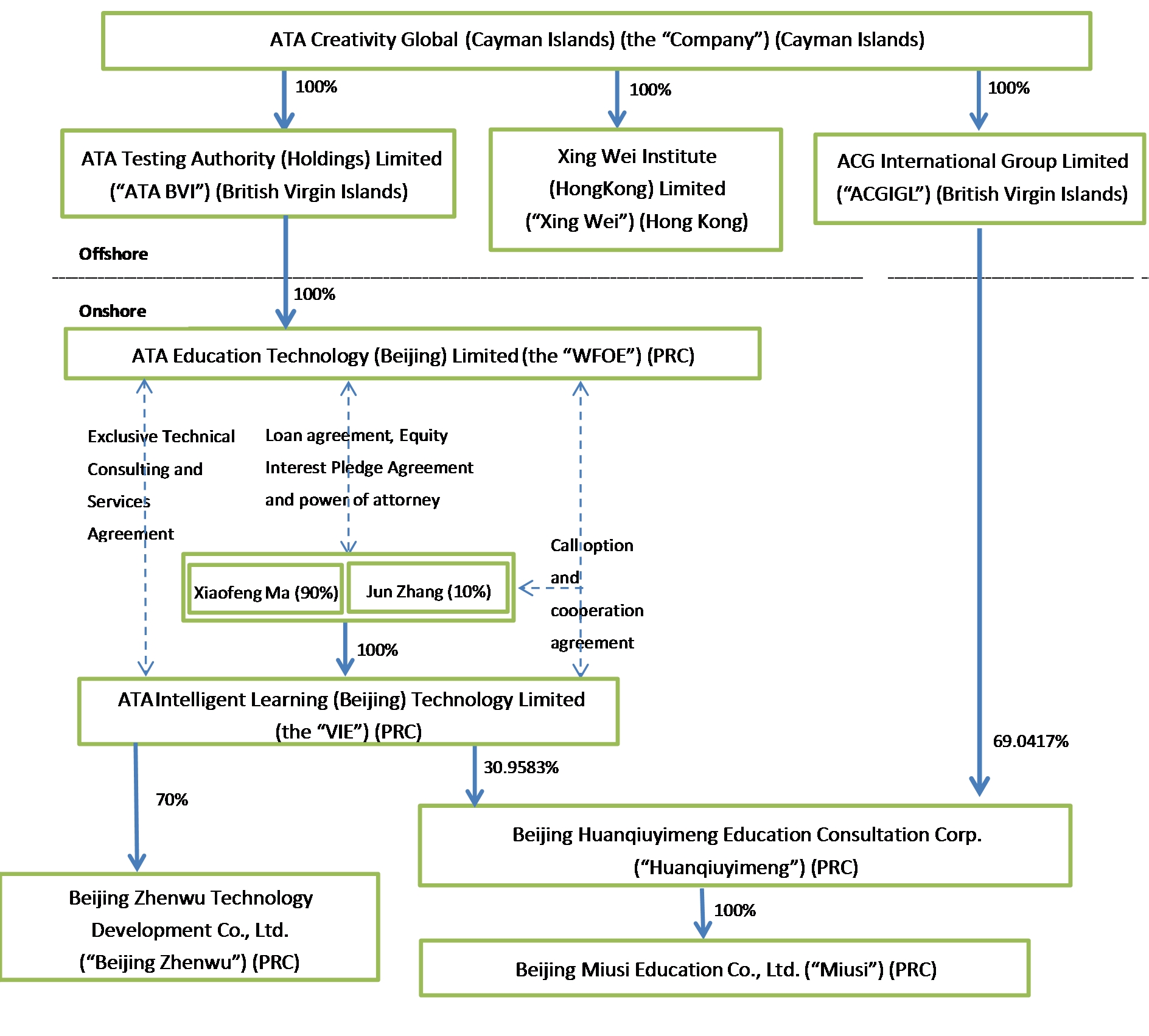

The Company will revise the Corporate Structure Diagram in its 2021 Form 20-F as below to identify clearly the entity in which investors have or can purchase their interest in and the entities in which the company’s operations are conducted:

Notes:

|

|

1) |

ATA Creativity Global is the entity in which investors hold or can purchase their interest. |

|

|

2) |

We conduct our operations through Huanqiuyimeng and its subsidiaries, including Miusi. Huanqiuyimeng provides portfolio training, overseas study counselling and other educational services together with its wholly owned subsidiaries and three of its majority owned subsidiaries, Sichuan Huanqiuyilian Education Consultation Co. Ltd., or Sichuan Huanqiuyilian, in which Huanqiuyimeng holds 60% equity interests, Chongqing |

|

|

Huanqiuyilian Education Information Consultation Co., Ltd., subsidiary of Sichuan Huanqiuyilian, in which Huanqiuyimeng indirectly holds 60% equity interests, and Dalian Huanqiuyimeng Education Consultation Co., Ltd., in which Huanqiuyimeng holds 70% equity interests. Miusi is mainly engaged in providing research-based learning service programs. |

|

|

3) |

As of the date hereof, the VIE has no business operations of its own, but holds 30.9583% equity interests in Huanqiuyimeng, and 70% equity interests in Beijing Zhenwu. Beijing Zhenwu was established in August 2021 mainly for purpose of developing and marketizing our project-based learning services, and has no business operations as of the date hereof. |

|

2. |

We note your response to comment number 9. Please revise the condensed consolidating schedule depicting cash flows to show cash changes from investing and financing activities individually to the extent they exceed 10% of the average of net cash flows from operating activities for the most recent three years. Refer to Rule 10-01(a)(4) of Regulation S-X. |

The Company respectfully advises the Staff that the following tables present the Company’s condensed consolidating schedule depicting the consolidated cash flows for the fiscal years ended December 31, 2018, 2019 and 2020 of the Company, its subsidiaries, the VIE, and corresponding eliminating adjustments separately, which have been revised to show significant cash changes from investing and financing activities individually to the extent they exceed 10% of the average of net cash flows from operating activities for the fiscal years ended December 31, 2018, 2019 and 2020, amounting to RMB 13,279,207.

|

|

|

Year Ended December 31, |

||||||||

|

|

|

2020 |

||||||||

|

|

|

The Company |

|

Subsidiaries of the Company |

|

VIE |

|

Elimination adjustments |

|

Consolidated |

|

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

Net cash used in operating activities |

|

(10,150,979) |

|

(17,256,377) |

|

(466,004) |

|

— |

|

(27,873,360) |

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

|

|

Payment for acquisition of a subsidiary, less cash acquired |

|

— |

|

— |

|

(15,000,000) |

|

— |

|

(15,000,000) |

|

Cash lent to inter-companies |

|

(72,794,230) |

|

(15,122,000) |

|

— |

|

87,916,230 |

|

— |

|

Other cash movements |

|

3,804,240 |

|

(4,090,428) |

|

— |

|

(3,804,240) |

|

(4,090,428) |

|

Net cash used in investing activities |

|

(68,989,990) |

|

(19,212,428) |

|

(15,000,000) |

|

84,111,990 |

(1) |

(19,090,428) |

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

|

|

Cash received from short-term loans |

|

— |

|

19,618,000 |

|

— |

|

— |

|

19,618,000 |

|

Repayment of short-term loans |

|

— |

|

(17,808,000) |

|

— |

|

— |

|

(17,808,000) |

|

Cash received from inter-companies |

|

— |

|

72,794,230 |

|

15,122,000 |

|

(87,916,230) |

|

— |

|

Other cash movements |

|

4,527,401 |

|

(3,838,047) |

|

— |

|

3,804,240 |

|

4,493,594 |

|

Net cash provided by financing activities |

|

4,527,401 |

|

70,766,183 |

|

15,122,000 |

|

(84,111,990) |

(1) |

6,303,594 |

|

Effect of foreign currency exchange rate changes on cash |

|

(895,932) |

|

81,801 |

|

— |

|

— |

|

(814,131) |

|

Net increase (decrease) in cash and cash equivalents |

|

(75,509,500) |

|

34,379,179 |

|

(344,004) |

|

— |

|

(41,474,325) |

|

Cash and cash equivalents at the beginning of the year |

|

77,996,136 |

|

75,766,500 |

|

435,122 |

|

— |

|

154,197,758 |

|

Cash and cash equivalents at the end of the year |

|

2,486,636 |

|

110,145,679 |

|

91,118 |

|

— |

|

112,723,433 |

|

|

|

Year Ended December 31, |

||||||||

|

|

|

2019 |

||||||||

|

|

|

The Company |

|

Subsidiaries of the Company |

|

VIE |

|

Elimination adjustments |

|

Consolidated |

|

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

Net cash used in operating activities |

|

(4,797,830) |

|

(51,637,369) |

|

(1,441,360) |

|

— |

|

(57,876,559) |

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

|

|

Payment for acquisition of a subsidiary, less cash acquired |

|

— |

|

36,929,271 |

|

(71,483,973) |

|

— |

|

(34,554,702) |

|

Cash repayment received from inter-companies |

|

— |

|

28,000,000 |

|

— |

|

(28,000,000) |

|

— |

|

Cash lent to inter-companies |

|

— |

|

(42,000,000) |

|

— |

|

42,000,000 |

|

— |

|

Cash lent to nominee shareholders of consolidated VIE |

|

— |

|

(40,000,000) |

|

— |

|

40,000,000 |

|

— |

|

Other cash movements |

|

4,894,197 |

|

(1,275,916) |

|

(6,008,900) |

|

— |

|

(2,390,619) |

|

Net cash provided by (used in) investing activities |

|

4,894,197 |

|

(18,346,645) |

|

(77,492,873) |

|

54,000,000 |

(1) |

(36,945,321) |

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

|

|

Cash received upon private placement |

|

61,693,192 |

|

— |

|

— |

|

— |

|

61,693,192 |

|

Cash repaid to inter-companies |

|

— |

|

— |

|

(28,000,000) |

|

28,000,000 |

|

— |

|

Cash received from inter-companies |

|

— |

|

— |

|

42,000,000 |

|

(42,000,000) |

|

— |

|

Cash received from nominee shareholders of consolidated VIE |

|

— |

|

— |

|

40,000,000 |

|

(40,000,000) |

|

— |

|

Other cash movements |

|

— |

|

(4,126,723) |

|

— |

|

— |

|

(4,126,723) |

|

Net cash provided by (used in) financing activities |

|

61,693,192 |

|

(4,126,723) |

|

54,000,000 |

|

(54,000,000) |

(1) |

57,566,469 |

|

Effect of foreign currency exchange rate changes on cash |

|

810,196 |

|

56,631 |

|

— |

|

— |

|

866,827 |

|

Net increase (decrease) in cash and cash equivalents |

|

62,599,755 |

|

(74,054,106) |

|

(24,934,233) |

|

— |

|

(36,388,584) |

|

Cash and cash equivalents at the beginning of the year |

|

15,396,381 |

|

149,820,606 |

|

25,369,355 |

|

— |

|

190,586,342 |

|

Cash and cash equivalents at the end of the year |

|

77,996,136 |

|

75,766,500 |

|

435,122 |

|

— |

|

154,197,758 |

|

|

|

Year Ended December 31, |

||||||||

|

|

|

2018 |

||||||||

|

|

|

The Company |

|

Subsidiaries of the Company |

|

VIE |

|

Elimination adjustments |

|

Consolidated |

|

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

Net cash used in operating activities |

|

(29,996,291) |

|

(282,457,869) |

|

(172,145) |

|

— |

|

(312,626,305) |

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

|

|

Proceeds from disposal of discontinued operations, net of cash disposed in the amount of RMB147,738,996 |

|

— |

|

1,223,119,391 |

|

— |

|

— |

|

1,223,119,391 |

|

Cash received from inter-companies |

|

1,001,941,215 |

|

— |

|

— |

|

(1,001,941,215) |

|

— |

|

Cash lent to inter-companies |

|

— |

|

(28,000,000) |

|

— |

|

28,000,000 |

|

— |

|

|

— |

|

(10,000,000) |

|

— |

|

10,000,000 |

|

— |

|

|

Loan lent to Beijing Biztour |

|

(13,745,856) |

|

— |

|

— |

|

— |

|

(13,745,856) |

|

Other cash movements |

|

— |

|

4,820,679 |

|

(12,458,500) |

|

— |

|

(7,637,821) |

|

Net cash provided by (used in) investing activities |

|

988,195,359 |

|

1,189,940,070 |

|

(12,458,500) |

|

(963,941,215) |

(1) |

1,201,735,714 |

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

|

|

Cash received from short-term loans |

|

— |

|

15,000,000 |

|

— |

|

— |

|

15,000,000 |

|

Repayment of short-term loans |

|

— |

|

(15,000,000) |

|

— |

|

— |

|

(15,000,000) |

|

Special cash dividend |

|

(946,611,803) |

|

— |

|

— |

|

— |

|

(946,611,803) |

|

Cash repaid to inter-companies |

|

— |

|

(1,001,941,215) |

|

— |

|

1,001,941,215 |

|

— |

|

Cash received from inter-companies |

|

— |

|

— |

|

28,000,000 |

|

(28,000,000) |

|

— |

|

Cash received from nominee shareholders of consolidated VIE |

|

— |

|

— |

|

10,000,000 |

|

(10,000,000) |

|

— |

|

Other cash movements |

|

1,433,441 |

|

(4,715,627) |

|

— |

|

— |

|

(3,282,186) |

|

Net cash provided by (used in) financing activities |

|

(945,178,362) |

|

(1,006,656,842) |

|

38,000,000 |

|

963,941,215 |

(1) |

(949,893,989) |

|

Effect of foreign currency exchange rate changes on cash |

|

568,046 |

|

(5,288,066) |

|

— |

|

— |

|

(4,720,020) |

|

Net increase (decrease) in cash and cash equivalents |

|

13,588,752 |

|

(104,462,707) |

|

25,369,355 |

|

— |

|

(65,504,600) |

|

Cash and cash equivalents at the beginning of the year |

|

1,807,629 |

|

254,283,313 |

|

— |

|

— |

|

256,090,942 |

|

Cash and cash equivalents at the end of the year |

|

15,396,381 |

|

149,820,606 |

|

25,369,355 |

|

— |

|

190,586,342 |

|

|

(1) |

To eliminate the amounts of cash inflows or outflows among the Company, subsidiaries of the Company and the VIE, mainly comprised of 1) loans provided by the Company to its subsidiaries and by the subsidiaries of the Company to the VIE, netting off by repayments; 2) dividends distributed by subsidiaries to the Company; 3) loans provided by a subsidiary of the Company (the WFOE) to nominee shareholders of the VIE as capital contribution, and 4) cash consideration payment made by the VIE to a subsidiary of the Company (the WFOE) in relation to the transfer of equity interests in a long-term investment in GlobalWisdom. |

Key Information, page 4

|

3. |

We note your proposed disclosure in response to comment 2 that the VIE structure is "designed to replicate substantially the same economic benefits as would be provided by direct ownership." We note, however, that the structure provides contractual exposure to foreign investment in such companies rather than replicating direct ownership. Please revise accordingly. |

In light of your comment above, the Company will use the below revised disclosures in its 2021 Form 20-F, with necessary updates based on the changes of facts or regulations by then, if any:

The Company is a Cayman Islands holding company with no material operations of its own. As of the date hereof, we conduct our operations through our PRC subsidiary Huanqiuyimeng and its subsidiaries. The Company, through its wholly owned subsidiary ACGIGL, holds 69.0417% of the equity interests of Huanqiuyimeng. The Company also has the power to direct activities of the VIE through the WFOE, and consolidates the VIE into its consolidated financial statements under U.S. GAAP. As of the date hereof, the VIE has no business operations of its own, but holds 30.9583% equity interests in Huanqiuyimeng, and 70% equity interests in Beijing Zhenwu, a PRC company newly established in August 2021 for purpose of developing and marketizing our project-based learning services but has no business operations as of the date hereof. Other than holding equity interests in Huanqiuyimeng and Beijing Zhenwu, the VIE also holds certain minority investment in two PRC companies. Notwithstanding the foregoing, as we are currently expanding our online courses and other services, for which an internet content provision license, or ICP license, may be required under PRC law, we may elect to provide such services through the VIE in the future if and to the extent that an ICP license or any other license or permission not available for foreign-invested companies is required. Variable interest entity structure is a structure commonly used to provide contractual exposure to foreign investment in China-based companies where PRC law prohibits direct foreign investment in the Chinese operating companies, and investors may never be able to directly hold equity interests in the VIE. PRC regulatory authorities could disallow our variable interest entity structure, which may result in a material change in our operations and/or value of our ADSs, including that it could cause the value of our ADSs to significantly decline or become worthless. See “Item 3.D. Risk Factors — Risks Relating to our Corporate Structure.”

|

uncertainties regarding the status of the rights of the Cayman Islands holding company with respect to its contractual arrangements with the VIE, its founders and owners. |

In light of your comment above, the Company will use the below revised disclosures in its 2021 Form 20-F, with necessary updates based on the changes of facts or regulations by then, if any:

Revised response to this comment and comment 5 in your September 23, 2021 comment letter:

We are a Cayman Islands holding company with operations conducted by our PRC subsidiary Huanqiuyimeng and its subsidiaries. 69.0417% of the equity interests of Huanqiuyimeng is indirectly owned by the Company though ACGIGL, a wholly owned subsidiary of the Company, and 30.9583% equity interests of Huanqiuyimeng is owned by the VIE. We, through the WFOE, entered into a series of contractual arrangements with the VIE and its shareholders, including (i) Powers of Attorney under which we can exclusively exercise all rights of shareholders of the VIE; (ii) Exclusive Technical Consulting and Services Agreement that allow us to have sole and exclusive right to provide specified technical and consulting services to the VIE and receive certain consulting fees from the VIE; (iii) Call Option and Cooperation Agreement and Loan Agreements that provide us with the option to purchase the equity interest in the VIE; and (vi) Equity Interest Pledge Agreements that guarantee the performance of the VIE and its shareholders’ obligations under the Exclusive Technical Consulting and Services Agreement and the Call Option and Cooperation Agreement. Under U.S. GAAP, pursuant to such contractual arrangements, the Company (i) has the power, through the WFOE, to direct activities of the VIE that most significantly impact the economic performance of the VIE; and (ii) the obligation to absorb the losses and the right to receive benefits of the VIE that could potentially be significant to the VIE As such, the Company is deemed to be the primary beneficiary of the VIE for accounting purposes and must consolidate the VIE. See “Item 4.A. History and Development of the Company — Our Consolidated Variable Interest Entity.” and “Item 4.A History and Development of the Company — Contractual Arrangements with the VIE.” However, these contractual arrangements may be less effective in providing operational control than direct ownership as the VIE’s shareholders may fail to perform their obligations under the contractual arrangements and we could incur substantial costs in enforcing these contractual arrangements if we are able to enforce these contractual arrangements at all. Our rights under such contractual agreements have not been tested in a court of law, and we cannot assure you that a court would enforce our contractual rights. There are substantial uncertainties regarding the interpretation and application of current and future PRC laws, regulations, and rules relating to such contractual arrangements, including potential future actions by the PRC government, which could affect the enforceability of our contractual arrangements with the VIE, and consequently, significantly affect our financial condition and results of operations. If the PRC government finds such agreements non-compliant with relevant PRC laws, regulations, and rules, we could be subject to severe penalties or be forced to relinquish our interests in the VIE or forfeit our rights under the contractual arrangements. See “Item 3.D. Risk Factors — Risks Relating to our Corporate Structure.”

Revised response to this comment and comment 11 in your September 23, 2021 comment letter:

We are a Cayman Islands holding company primarily operating in China through our PRC subsidiaries and may conduct business through the VIE in the future. Investors purchasing our ADSs are not purchasing, and may never directly hold, equity interests in the VIE. There are substantial uncertainties regarding the interpretation and application of current and future PRC laws, regulations, and rules relating to such agreements, including potential future actions by the PRC government, which could affect the enforceability of our contractual arrangements with the VIE, and consequently, significantly affect our financial condition and results of operations.

We are a Cayman Islands holding company with operations conducted by our PRC subsidiary Huanqiuyimeng and its subsidiaries. 69.0417% of the equity interests of Huanqiuyimeng is indirectly owned by the Company through a wholly owned subsidiary and 30.9583% equity interests of Huanqiuyimeng is owned by the VIE. As we are currently expanding our online courses and other services, for which an ICP license may be required under PRC law, we may elect to provide such services through the VIE in the future if and to the extent that an ICP license or any other license or permission not available for foreign-invested companies is required.

The VIE is 90% owned by Mr. Xiaofeng Ma, our chairman of the board and chief executive officer, and 10% owned by Mr. Jun Zhang, our president. Mr. Ma and Mr. Zhang are PRC citizens. We entered into a series of contractual arrangements with the VIE and its shareholders, which enable us to:

|

|

• |

exercise all rights of shareholders of the VIE; |

|

|

• |

exclusively provide specified technical and consulting services to the VIE and receive consulting fees from the VIE; and |

|

|

• |

have an exclusive option to purchase all or part of the equity interests in the VIE when and to the extent permitted by PRC law. |

Pursuant to such contractual arrangements, the Company has the power to direct activities of the VIE through the WFOE, and consolidates the VIE into its consolidated financial statements under U.S. GAAP. For a detailed discussion of these contractual arrangements, see “Item 4.A. History and Development of the Company — Contractual Arrangements with the VIE”.

In the opinion of Jincheng Tongda & Neal Law Firm, our PRC legal counsel, the above contractual arrangements are legally binding and enforceable and do not violate current PRC laws and regulations. However, such contractual arrangements have not been tested in a court of law, and uncertainties in the PRC legal system could limit our ability to enforce the contractual arrangements, and we cannot assure that the PRC regulatory authorities will not ultimately take a contrary view to our opinion. If our current ownership structure and contractual arrangements with the VIE are found to be in violation of any existing or future PRC laws and regulations, the PRC government could:

|

|

• |

revoke our and the VIE’s business and operating licenses; |

|

|

• |

levy fines on us and the VIE; |

|

|

• |

confiscate any of our and the VIE’s income that they deem to be obtained through illegal operations; |

|

|

• |

shut down a portion or all of our or the VIE’s servers or block a portion or all of our or the VIE’s websites; |

|

|

• |

discontinue or restrict our and the VIE’s operations in China; |

|

|

• |

impose conditions or requirements with which we and the VIE may not be able to comply; |

|

|

• |

require us and the VIE to restructure its corporate and contractual structure; and |

|

|

• |

take other regulatory or enforcement actions that could be harmful to our and the VIE’s business. |

In addition, these contractual arrangements may not be as effective as direct ownership providing us with operational control over the VIE. See “Risks Related to Our Corporate Structure — We rely on contractual arrangements with the VIE and its shareholders to consolidate the VIE, which may not be as effective in providing operational control as direct ownership, and the VIE’s shareholders may fail to perform their obligations under the contractual arrangements.” In the event we are unable to enforce these contractual arrangements or we experience significant delays or other obstacles in the process of enforcing these contractual arrangements, we may not be able to exert effective control over the VIE and may lose control over the assets owned by the VIE for accounting purposes. Our financial performance may be adversely and materially affected as a result and we may not be eligible to consolidate the financial results of the VIE into the Company’s consolidated financial results.

We rely on contractual arrangements with the VIE and its shareholders to consolidate the VIE, which may not be as effective in providing operational control as direct ownership, and the VIE’s shareholders may fail to perform their obligations under the contractual arrangements.

We rely on the contractual arrangements with the VIE and its shareholders to consolidate the VIE. Pursuant to the contractual arrangements, the Company has the power to direct activities of the VIE through the WFOE, and consolidates the VIE into its consolidated financial statements under U.S. GAAP

Although we have been advised by our PRC legal counsel, that our contractual arrangements constitute valid and binding obligations enforceable against each party of such agreements in accordance with their terms, the contractual arrangements may not be as effective in providing operational control over the VIE as direct ownership. If we had direct ownership of the VIE, we would be able to exercise our rights as a shareholder to vote with respect to matters subject to shareholder approval and also to effect changes in the VIE’s board of directors, which in turn could effect changes, subject to any applicable fiduciary obligations, at the management level.

However, under the current contractual arrangements, we rely on the performance by the VIE and its shareholders of their obligations under the contracts to exercise control over the VIE for accounting purpose. The shareholders of the VIE may not act in the best interests of the Company or may not perform their obligations under these contracts. Such risks exist throughout the period in which we intend to operate our business through the contractual arrangements with the VIE. If the VIE or its shareholders fail to perform their obligations under our contractual arrangements, we may have to incur substantial costs and expend additional resources to enforce such arrangements. For example, if the shareholders of the VIE were to refuse to transfer their equity interest in the VIE to us or our designee when we exercise the purchase option pursuant to these contractual arrangements, or if they were otherwise to act in bad faith toward us, we may have to take legal actions to compel them

to perform their contractual obligations. All of these contractual arrangements are governed by and interpreted in accordance with PRC laws, and disputes arising from these contractual arrangements will be resolved through arbitration or litigation in the PRC. However, the legal system in the PRC is not as developed as in other jurisdictions, such as the United States. See “Risks Relating to Doing Business in the People’s Republic of China — The PRC legal system has inherent uncertainties that could limit the legal protections available to you and us and the VIE, and rules and regulations in China can change quickly with little advance notice.” Meanwhile, there are very few precedents and little formal guidance as to how contractual arrangements in the context of a variable interest entity should be interpreted or enforced under PRC law, and as a result it may be difficult to predict how an arbitration panel would view such contractual arrangements. As a result, uncertainties in the PRC legal system could limit our ability to enforce these contractual arrangements. Additionally, under PRC law, rulings by arbitrators are final, parties cannot appeal the arbitration results in courts, and if the losing parties fail to carry out the arbitration awards within a prescribed time limit, the prevailing parties may only enforce the arbitration awards in PRC courts through arbitration award recognition proceedings, which would require additional expenses and delay. Therefore, our contractual arrangements with the VIE may not be as effective in ensuring our control over the VIE for accounting purpose as direct ownership would be. In the event we are unable to enforce our contractual arrangements, we may not be able to exert effective control over the VIE for accounting purpose, and we may not be eligible to consolidate the financial results of the VIE into the Company’s consolidated financial results.

|

5. |

We note your proposed disclosure in response to comment 6. Please revise to ensure that you provide cross-references to each of the more detailed discussion of these risks in the annual report. |

The Company respectfully advises the Staff that it will provide in the risk factors summary section in its 2021 Form 20-F cross references to the more detailed discussions of the related risks.

|

6. |

We note your response to comment 7. Revise to describe the consequences to you and your investors if you, your subsidiaries, or the VIEs: (i) do not receive or maintain such permissions or approvals, (ii) inadvertently conclude that such permissions or approvals are not required, or (iii) applicable laws, regulations, or interpretations change and you are required to obtain such permissions or approvals in the future. |

In light of your comment above, the Company will use the below revised disclosures in its 2021 Form 20-F, with necessary updates based on the changes of facts or regulations by then, if any:

As of the date hereof, we believe that our PRC subsidiaries and the VIE have obtained the requisite licenses and permits from the PRC government authorities that are material for the business operations of us and the VIE in the PRC, mainly including the ICP license obtained by the VIE, and no permissions have been denied. However, as PRC laws and regulations with respect to certain licenses and permissions are unclear and are subject to interpretations and enforcement of local governmental authorities, we and the VIE may be required to obtain additional licenses. For example, according to the Law for Promoting Private Education, as amended by the Standing Committee of the National People’s Congress December 29, 2018, (the “Amended Private Education Law”), and the Amended

Implementation Rules for the Law for Promoting Private Education newly promulgated by the State Council on April 7, 2021 which became effective since September 1, 2021 (the “Amended Implementation Rules”), private schools are required to obtain operating permits from relevant PRC authorities for carrying out educational activities. Although the Amended Private Education Law generally states that private education institutions are also included in the category of “private schools”, as of the date hereof, relevant implementing rules only require private education institutions providing tutoring services on academic subjects for K-12 students and certain vocational skill education services to obtain private school operating permits, and there is no implementing rules that require private education institutions focusing on art or other non-academic cultural education to obtain private school operating permits. To date, we and the VIE have not received any notifications for rectification or administrative measure which requires us and the VIE to obtain private school operating permits. However, since related regulatory regime of education industry in the PRC continues to rapidly evolve, the interpretations of relevant regulations and rules are not always uniform, and the enforcement of relevant regulations and rules involve uncertainties, we cannot assure you that our training centers will not be classified as a “private school” and thus be required to obtain private school operating permits by the regulators due to any future and further development, interpretation and enforcement of relevant regulations and rules. To date, only one of our training centers in Qingdao has obtained private school operating permit. If the regulators do not take the same view as we do or applicable laws, regulations, or interpretations change, and thus our other training centers are required by the regulators to obtain private school operating permits or other permits and they fail to obtain such permits, we may be subject to various penalties, including fines, orders to promptly rectify the non-compliance, or if the non-compliance is deemed serious by the regulators, our training centers may be ordered to return course and service fees collected and pay a multiple of the amount of returned course and/or service fees to regulators as a penalty or may even be ordered to cease operations. If this occurs, our business, results of operations and financial condition could be materially and adversely affected.

On July 6, 2021, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued the Opinions on Severe and Lawful Crackdown on Illegal Securities Activities, or the Crackdown Opinions. The Crackdown Opinions emphasized the need to strengthen the administration over illegal securities activities and the supervision on overseas listings by China-based companies. The Crackdown Opinions proposed to take effective measures, such as promoting the construction of relevant regulatory systems to deal with the risks and incidents facing China-based overseas-listed companies and the demand for cybersecurity and data privacy protection. As of the date hereof, we believe the permission and approval of the China Securities Regulatory Commission, or CSRC, is not required for us and the VIE, but as the Crackdown Opinions were recently issued, official guidance and interpretation of the opinions remain unclear in several respects at this time, we cannot assure you that we and the VIE will remain fully compliant with all new regulatory requirements of the Crackdown Opinions or any future implementation rules on a timely basis, or at all. If we and the VIE are unable to obtain such permission or approval if required in the future, then the value of our ADSs may significantly decline or become worthless.

On December 24, 2021, the CSRC published Provisions of the State Council on the Administration of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comments) (the “Draft Overseas Offering and Listing Provisions”) and the

Administrative Measures for the Filing of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comments) (the “Draft Registration Measures”, and collectively with the Draft Overseas Offering and Listing Provisions, the “Overseas Offering and Listing Regulations Drafts”), which provide principles and guidelines for direct and indirect issuance of securities overseas by a Chinese domestic company. Under the Overseas Offering and Listing Regulations Drafts, the substance rather than the form of issuance will govern when determining whether an issuance constitutes “indirect issuance of securities overseas by a Chinese domestic company”, and in the event any listing or issuance of securities falls under such definition, the issuer shall assign one of its related major Chinese domestic operating entities to make filings with CSRC within three business days after its initial public offering or any offerings after the initial public offering. It is uncertain when the final regulations of the Overseas Offering and Listing Regulations Drafts will be issued and take effect, and how they will be enacted, interpreted or implemented. We cannot assure you that we will not in the future be required to obtain the approval of the CSRC or of potentially other regulatory authorities in order to maintain the listing status of our common shares on the Nasdaq or to conduct offerings of securities in the future. In the event that it is determined that we are required to obtain approval from the CSRC or any other regulatory authority, the failure to obtain such approval could result in the delisting of our securities from the Nasdaq and/or a decrease in the value of our securities. See “Item 3.D. Risk Factors — Risks Relating to Regulations of Our Business — The approval, filing or other requirements of the CSRC or other PRC government authorities may be required under PRC law in connection with our issuance of securities overseas.”

On December 28, 2021, the Cyberspace Administration of China, or the CAC, published the Measures for Cybersecurity Review (the “Cybersecurity Review Measures”), which became effective on February 15, 2022, which, among others, provide that internet platform operators engaging in data processing activities that affect or may affect national security should be subject to cybersecurity reviews and require that any internet platform operator applying for listing on a foreign exchange must go through cybersecurity review if it possesses personal information of more than one million users. We believe we would not be subject to the cybersecurity review by the CAC, given that we do not possess a large amount of personal information in our business operations, and data processed in our business does not have a bearing on national security and thus may not be classified as core or important data by the authorities. However, we cannot assure you that PRC regulatory agencies, including the CAC, would take the same view as we do, and there remains uncertainty as to how the Cybersecurity Review Measures will be interpreted or implemented and whether the PRC regulatory agencies, including the CAC, may adopt new laws, regulations, rules, or detailed implementation and interpretation related to the Cybersecurity Review Measures. In the event that we are subject to any mandatory cybersecurity review and other specific actions required by the CAC, we will face uncertainty as to whether any clearance or other required actions can be timely completed, or at all. Given such uncertainty, we may be required in the future to suspend our relevant business, shut down our website, or face other penalties, which could materially and adversely affect our business, financial condition, and results of operations, and/or the value of our ADSs, or could significantly limit or completely hinder our ability to offer or continue to offer securities to investors. As of the date hereof, we have not received any notice from regulatory authorities requiring us to going through cybersecurity review by the CAC. See “Item 3.D. Risk Factors — Risks Relating to Regulations of Our Business — Failure to comply with regulations relating to information security and privacy protection, breaches

or perceived breaches of our security measures relating to our service offerings, unauthorized disclosure or misuse of personal data through breaches of our computer systems or otherwise, could result in negative publicity and loss of students, expose us to protracted and costly litigation, and harm our business and results of operations. Additionally, it is unclear whether we will be subject to the oversight of the CAC and how such oversight may impact us.”

|

7. |

We note your response to comment 8. Provide cross-references to the condensed consolidating schedule and the consolidated financial statements. |

In light of your comment above, the Company revised its response to comment 8 in your September 23, 2021 comment letter as below to provide cross-references to the condensed consolidating schedule and the consolidated financial statements to the extent that cross-references are available. The Company also respectfully advises the Staff that, certain numbers in the Company’s response to comment 8 are included in certain line items in the Company’s condensed consolidating schedule and consolidated financial statements but not separately presented because they are not as significant for separate presentation and thus we used language “included in” when providing cross-references, and certain numbers in the Company’s response to comment 8 are eliminated in the condensed consolidating schedule and the consolidated financial statements and thus no cross-reference to a specific line item is available.

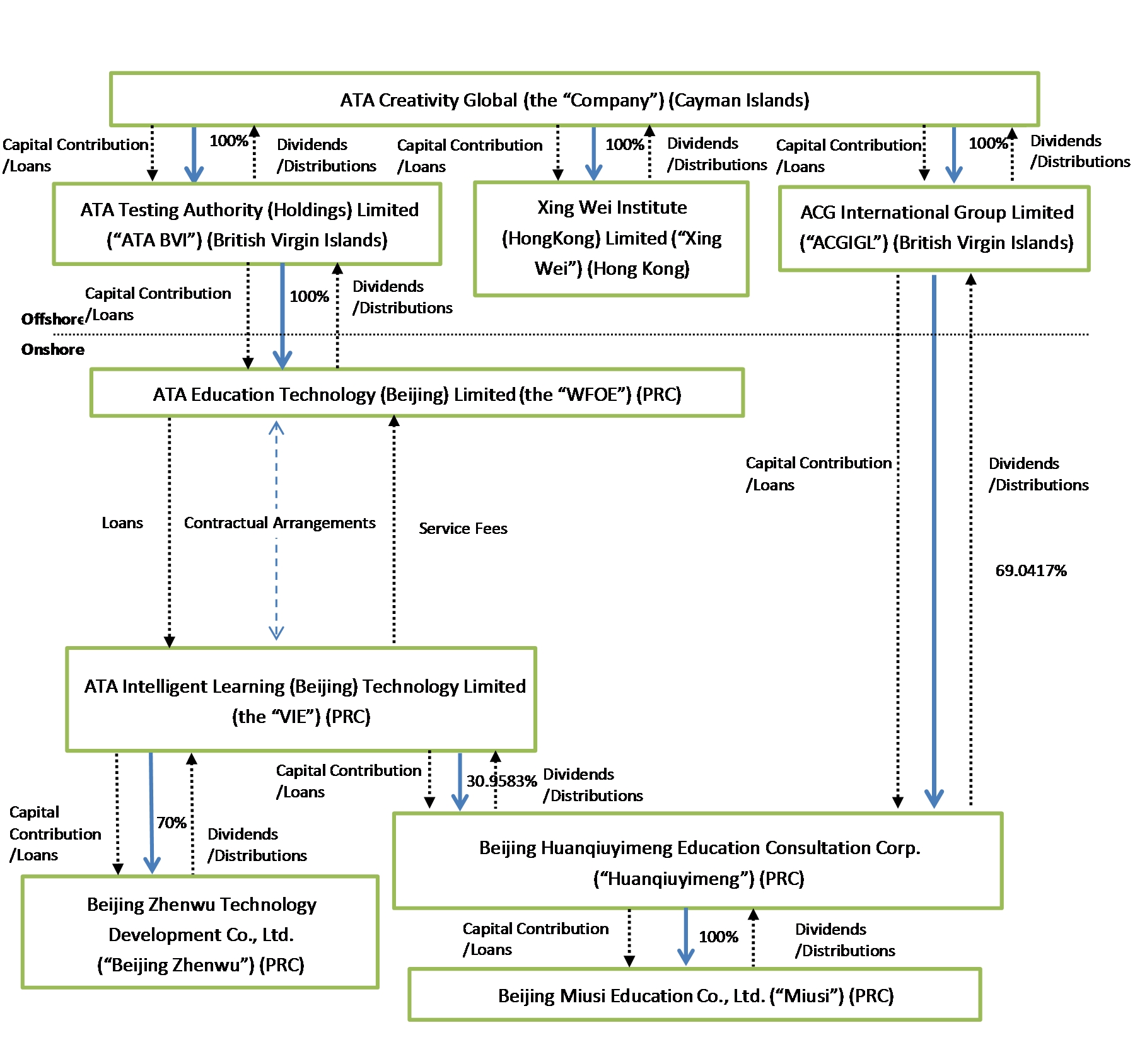

(a)Description of how cash is transferred through our organization

We have adopted a holding company structure, and our holding companies may rely on dividends and other distributions on equity paid by our current and future PRC subsidiaries or cash paid by the VIE under the VIE arrangement for their cash requirements, including the funds necessary to service any debt we may incur or financing we may need for operations not carried through our PRC subsidiaries or the VIE.

The Company may transfer funds to ATA BVI, Xing Wei and ACGIGL through capital contribution into or a shareholder loan to such subsidiaries respectively. ATA BVI and ACGIGL may transfer funds to the WFOE and Huanqiuyimeng through capital contribution into or a shareholder loan to the WFOE and Huanqiuyimeng respectively. The WFOE and Huanqiuyimeng may transfer funds to their respective subsidiaries through capital contribution into or a shareholder loan to them. The WFOE provides comprehensive business support, technical services, consultancy, etc. in exchange for service fees from the VIE. The WFOE may also provide loans to the VIE, subject to statutory limits and restrictions. In addition, the VIE may also receive dividends from its subsidiaries or investing companies, including Huanqiuyimeng, Beijing Zhenwu, etc.

The following diagram illustrates the typical fund flow through our organization (including the VIE).

(b)Cash flow and assets transfer between the Company, its subsidiaries, and the VIE

The cash inflows of the Company for the year ended December 31, 2018 were primarily received from the earnings distributed from its subsidiaries amounting to US$55.0 million and cash consideration of US$102.0 million received in connection with the ATA Online Sale Transaction, among which US$137.7 million was paid to the Company’s investors as dividends with the rest being remained in the Company to support its operations. Such numbers are included in or correspond to the numbers under line items of “Cash flows from investing activities - Cash received from inter-companies”, “Cash flows from financing activities - Cash repaid to inter-companies” and “Cash flows from financing activities - Special cash dividend” in the Company’s condensed consolidating schedule depicting the consolidated cash flows (“Condensed Cash Flow Schedule”) for fiscal year 2018 and the line item of “Cash flows from financing activities - Special cash dividend” in the Company’s consolidated statements of cash flows for fiscal year 2018. For the year ended December 31, 2019, the Company received cash inflows of US$8.9 million in December 2019 from new investors through a private placement. See line item of “Cash flows from financing activities - Cash received upon private placement” in the Company’s Condensed Cash Flow Schedule for fiscal year 2019, and the Company’s consolidated statements of cash flows for fiscal year 2019. For the year ended December 31, 2020, the Company received cash inflows of US$1.2 million in April 2020 from new investors through a private

placement. Such number is included in the line item of “Cash flows from financing activities - Other cash movements” in the Company’s Condensed Cash Flow Schedule for fiscal year 2020 as it is not as significant to be separately presented. Such number is also presented under line item of “Cash flows from financing activities - Cash received upon private placement” in the Company’s consolidated statements of cash flows for fiscal year 2020.

Cash is transferred from the Company to its subsidiaries through shareholder loan and capital contribution. For the year ended December 31, 2019, a subsidiary of the Company (ATA BVI) provided a loan of US$2.0 million to its subsidiaries in December 2019. For the year ended December 31, 2020, a subsidiary of the holding companies (ATA BVI) made capital contribution of US$5.0 million to its subsidiaries in March 2020. These cash flows were classified as investing activities of the Company and financing activities of the Company’s subsidiaries, respectively, and were eliminated within the column of "Subsidiaries of the Company" of the Company’s Condensed Cash Flow Schedule for fiscal years 2019 and 2020, respectively. For the year ended December 31, 2020, the Company transferred RMB72.8 million, primarily the proceeds it received from the private placement, to its subsidiaries in supporting of their operations. See line items of “Cash flows from investing activities - Cash lent to inter-companies” and “Cash flows from financing activities - Cash received from inter-companies” in the Company’s Condensed Cash Flow Schedule for fiscal year 2020 (Note: this transfer of RMB72.8 million was inadvertently omitted in our prior response and is newly added in this revised response).

To date, we and the VIE have not distributed any earnings or settled any amounts owed under the VIE agreements. We and the VIE do not currently have any plans to distribute earnings or settle amounts owed under the VIE agreements.

For the years ended December 31, 2018, 2019 and 2020, due to the fact that the VIE did not provide material services, the VIE did not generate material cash inflows from the delivery of services, and its cash inflows were primarily generated via loan arrangement from subsidiaries of the Company. For the years ended December 31, 2018, 2019 and 2020, the VIE borrowed RMB28.0 million, which was repaid in full in 2019, RMB42.0 million and RMB15.1 million from subsidiaries of the Company respectively. See line items of “Cash flows from investing activities - Cash lent to inter-companies/ Cash repayment received from inter-companies” and “Cash flows from financing activities - Cash received from inter-companies/ Cash repaid to inter-companies” in the Company’s Condensed Cash Flow Schedule for fiscal years 2018, 2019 and 2020. As of December 31, 2020, the outstanding payables due to subsidiaries of the Company was RMB57.1 million and was eliminated during the consolidation process. These cash flows are classified as the Company’s subsidiaries investing activities and financing activities of the VIE, respectively.

For the year ended December 31, 2018, the WFOE transferred its long-term investment in Beijing GlobalWisdom Information Technology Co., Ltd (“GlobalWisdom”) to the VIE for a consideration of RMB12.45 million and the VIE transferred cash consideration to the WFOE in the amount of RMB12.45 million. Such number is included in the line item of “Cash flows from investing activities - Other cash movements” in the Company’s Condensed Cash Flow Schedule for fiscal year 2018 as such number is not as significant to be separately presented.

The WFOE has provided loans of RMB0.9 million and RMB0.1 million to Mr. Xiaofeng Ma (Chairman and CEO of the Company) and Mr. Haichang Xiong (former General Legal Counsel of the Company), nominee shareholders of the VIE, as initial capital contribution into the VIE in April 2018, respectively. In December 2018, the WFOE provided additional loans of RMB8.1 million and RMB0.9 million to Mr. Xiaofeng Ma and Mr. Haichang Xiong as capital contribution into the VIE, respectively. See line item of “Cash flows from investing activities - Cash lent to nominee shareholders of consolidated VIE” and “Cash flows from financing activities - Cash received from nominee shareholders of consolidated VIE” in the Company’s Condensed Cash Flow Schedule for fiscal year 2018. In April and June 2019, the WFOE provided additional loans in total of RMB36.0 million and RMB4.0 million to Mr. Xiaofeng Ma and Mr. Haichang Xiong as another round of capital contribution into the VIE, respectively. See the line items of “Cash flows from investing activities - Cash lent to nominee shareholders of consolidated VIE” and “Cash flows from financing activities - Cash received from nominee shareholders of consolidated VIE” in the Company’s Condensed Cash Flow Schedule for fiscal year 2019. In August 2020, the prior nominee shareholder Mr. Haichang Xiong transferred his 10% equity shares in the VIE to Mr. Jun Zhang (President and Director of the Company) and paid back the entire RMB5.0 million loan to the WFOE, and the WFOE provided a loan in RMB5.0 million to Mr. Jun Zhang to acquire the 10% equity interests of the VIE. Such numbers are included in the line item of “Cash flows from investing activities/financing activities - Other cash movements” in the Company’s Condensed Cash Flow Schedule for fiscal year 2020 as they are not as significant to be separately presented. These cash flows are classified as the related subsidiaries’ investing activities and financing activities of the VIE, respectively. As of December 31, 2020, receivables due from Mr. Xiaofeng Ma and Mr. Jun Zhang in the balance of RMB 45.0 million and RMB 5.0 million respectively were recorded as the receivables due from related parties for VIE.

Other than the above, no assets were transferred among the Company, its subsidiaries, and the VIE for the years ended December 31, 2018, 2019 and 2020.

(c)Dividends or distributions made to the Company and tax consequences thereof

In connection with the ATA Online Sale Transaction, the Company’s former wholly owned subsidiary of ATA Learning has distributed a total of RMB261.6 million dividend to the Company through ATA BVI in July 2018. The dividends were mainly paid out of the proceeds received from the sale of the ATA Online Business. According to relevant PRC tax rules, 10% withholding tax was imposed on any dividends or distributions made across border outbound for PRC entities. Therefore, RMB26.2 million withholding tax in relation to this dividend distribution was paid to tax authority in China. The Company’s wholly owned Hong Kong subsidiary Xing Wei has distributed a total of US$18.3 million to the Company in August 2018. The dividends were mainly paid out of the proceeds Xing Wei received from the sale of the ATA Online Business. No taxes were imposed for such distribution of earnings per laws of Hong Kong. Such dividend amounts are included in the line item “Cash flows from investing activities - Cash received from inter-companies” in the Company’s Condensed Cash Flow Schedule for fiscal year 2018.

Other than the foregoing, the Company’s current subsidiaries and the VIE did not make any dividends or distributions to the Company in the fiscal years ended 2018, 2019 and 2020. If any dividend is paid by our PRC subsidiaries to the Company in the future, under China’s EIT Law and its Implementation Rules, dividends from our PRC subsidiaries to its non-

PRC shareholders may be subject to a 10% withholding tax if such dividends are derived from profits. If the Company or its offshore subsidiaries are deemed to be a PRC resident enterprise (we do not currently consider the Company or its offshore subsidiaries to be PRC resident enterprises), the withholding tax may be exempted, but the Company or its offshore subsidiaries will be subject to a 25% tax on our worldwide income, and our non-PRC enterprise investors may be subject to PRC income tax withholding at a rate of 10%. See “Item 3.D. Risk Factors — Risks Relating to Regulations of Our Business — Under the EIT Law, we may be classified as a ‘resident enterprise’ of China. Such classification will likely result in unfavorable tax consequences to us and U.S. holders of our ADSs or common shares” and “Item 10.E. Taxation — People’s Republic of China Taxation.” If any payment is made from the VIE to the WFOE pursuant to the contractual arrangements between them, such payments will be subject to PRC taxes, including business taxes and VAT.

(d)Dividends or distributions made to the U.S. investors and tax consequences thereof

On August 8, 2018, the Company declared a special cash dividend of US$3.00 per common share, or US$6.00 per ADS in connection with the final closing of the sale of the ATA Online Business. The total amount of cash dividend distributed was approximately US$137.3 million, which was paid on August 24, 2018 out of the proceeds we received from the sale of the ATA Online Business to all shareholders of records as of the close of business on August 20, 2018. No taxes were imposed per laws and tax rules of Cayman Islands. US Investors who received the dividends will need to include the dividends in filing their tax returns respectively. See line item of “Cash flows from financing activities - Special cash dividend” in the Company’s Condensed Cash Flow Schedule for fiscal year 2018, and the line item of “Cash flows from financing activities - Special cash dividend” in the Company’s consolidated statements of cash flows for fiscal year 2018.

The Company did not make any dividends or distributions to its shareholders in the fiscal years ended 2018, 2019 and 2020 after August 8, 2018. Any future determination to pay dividends will be made at the discretion of our board of directors and will be based upon our future operations and earnings, capital requirements and surplus, general financial condition, shareholders’ interests, contractual restrictions and other factors our board of directors may deem relevant.

Under the current laws of Cayman Islands, no Cayman Islands withholding tax is imposed upon any payments of dividends by the Company. However, if the Company is considered a PRC tax resident enterprise for tax purposes (we do not currently consider the Company to be a PRC resident enterprise), any dividends that the Company pays to its overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding tax. See “Item 3.D.— Risk Factors — Risks Relating to Regulations of Our Business — Under the EIT Law, we may be classified as a ‘resident enterprise’ of China. Such classification will likely result in unfavorable tax consequences to us and U.S. holders of our ADSs or common shares” and “Item 10.E. Taxation — People’s Republic of China Taxation.”

In addition, subject to the passive foreign investment company rules, the gross amount of any distribution that the Company makes to investors with respect to our ADSs or common shares (including any amounts withheld to reflect PRC withholding taxes) will be taxable as a dividend, to the extent paid out of our current or accumulated earnings and profits, as determined under United States federal income tax principles.

(e) Restrictions on foreign exchange and our ability to transfer cash between entities, across borders, and to U.S. investors. Restrictions and limitations on our ability to distribute earnings from our businesses

We are a Cayman Islands holding company with operations conducted by our PRC subsidiaries, and we may conduct business operations through contractual arrangements with the VIE in the future. As a result, although other means are available for us to obtain financing at the Company level, the Company’s ability to pay dividends to its shareholders and to service any debt it may incur may depend upon dividends paid by our PRC subsidiaries and license and service fees paid by the VIE. If any of our PRC subsidiaries or the VIE incurs debt on its own in the future, the instruments governing such debt may restrict its ability to pay dividends to the Company. If any of our PRC subsidiaries or the VIE is unable to receive all or majority of the revenues from our and the VIE’s operations, we may be unable to pay dividends on our ADSs or common shares.

The PRC government also imposes controls on the convertibility of Renminbi into foreign currencies and, in certain cases, the remittance of currency out of China. The majority of our revenue is or will be received in Renminbi and shortages in foreign currencies may restrict our ability to pay dividends or other payments. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from trade-related transactions, can be made in foreign currencies without prior approval from SAFE as long as certain procedural requirements are met. Approval from or filing with appropriate government authorities is required if Renminbi is converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC government may, at its discretion, impose restrictions on access to foreign currencies for current account transactions and if this occurs in the future, we may not be able to pay dividends in foreign currencies to our shareholders or repay our loans.

Also, PRC legal restrictions permit payments of dividends by our PRC subsidiaries only out of their accumulated after-tax profits, if any, determined in accordance with PRC GAAP. Each of our PRC subsidiaries is also required under PRC laws and regulations to allocate at least 10% of its after-tax profits determined in accordance with PRC GAAP to statutory reserves until such reserves reach 50% of its registered capital. Allocations to these statutory reserves and funds can only be used for specific purposes and are not transferable to us in the form of loans, advances or cash dividends. In addition, registered share capital and capital reserve accounts are also restricted from withdrawal in the PRC, up to the amount of net assets held in each operating subsidiary. See “Item 3.D. Risk factors - Risks Relating to Regulations of Our Business - Because we may rely on dividends and other distributions on equity paid by our current and future PRC subsidiaries for our cash requirements, restrictions under PRC law on their ability to make such payments could materially and adversely affect our ability to grow, make investments or acquisitions that could benefit our business, pay dividends to you, and otherwise fund and conduct our businesses.”

In addition, there are substantial uncertainties regarding the interpretation and application of current and future PRC laws, regulations and rules relating to VIE agreements, and the VIE agreements with the VIE and its shareholders may not be as effective as direct ownership in providing us with control over the VIE. The uncertainty with respect to the

validity and enforceability of the VIE agreements may limit our ability to settle amounts owed under the VIE agreements. See “Item 3.D. Risk factors — Risks Relating to Our Corporate Structure.

Risk Factors, page 16

|

8. |

We note your response to comment 10. Update your disclosure to reflect that the Commission adopted rules to implement the HFCAA and that, pursuant to the HFCAA, the PCAOB has issued its report notifying the Commission of its determination that it is unable to inspect or investigate completely accounting firms headquartered in mainland China or Hong Kong. Acknowledge whether your auditor is subject to the determinations announced by the PCAOB on December 16, 2021. |

In light of your comment above, the Company will use the below revised disclosures in its 2021 Form 20-F, with necessary updates based on the changes of facts or regulations by then, if any:

Trading in our common shares may be prohibited under the Holding Foreign Companies Accountable Act, or HFCAA, because our auditor is not currently inspected by the PCAOB. See “Item 3.D. Risk Factors — Risks Relating to Doing Business in the People’s Republic of China — The audit report included in this annual report is prepared by an auditor who is not inspected by the PCAOB and, as such, trading in our securities may be prohibited and our ADSs may be delisted under the HFCAA. The delisting of our ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment. Additionally, the inability of the PCAOB to conduct full inspections deprives you with the benefits of such inspections.”

The audit report included in this annual report is prepared by an auditor who is not inspected by the PCAOB and, as such, trading in our securities may be prohibited and our ADSs may be delisted under the HFCAA. The delisting of our ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment. Additionally, the inability of the PCAOB to conduct full inspections deprives you with the benefits of such inspections.

Our independent registered public accounting firm that issues the audit reports included in our annual reports filed with the SEC, as an auditor of companies that are traded publicly in the United States and a firm registered with the PCAOB, is required by the laws of the United States to undergo regular inspections by the PCAOB to assess its compliance with the laws of the United States and professional standards. On December 16, 2021, the PCAOB issued a report on its determination that the PCAOB is unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China or Hong Kong, because of positions taken by PRC authorities in those jurisdictions. Because our auditor is located in mainland China, our auditor is subject to such PCAOB determination.

On December 18, 2020, the HFCAA was enacted according to which, among others, if the SEC determines that we have filed audit reports issued by a registered public accounting firm that has not been subject to inspection by the PCAOB for three consecutive years, the SEC shall prohibit our common shares or ADSs from being traded on a national securities exchange or in the over the counter trading market in the United States. On June 22, 2021,

the U.S. Senate passed a bill which, if passed by the U.S. House of Representatives and signed into law, would reduce the number of consecutive non-inspection years required for triggering the prohibitions under the HFCAA from three years to two.

On March 24, 2021, the SEC adopted interim final rules relating to the implementation of certain disclosure and documentation requirements of the HFCAA. On September 22, 2021, the PCAOB adopted a final rule implementing the HFCAA, which provides a framework for the PCAOB to use when determining, as contemplated under the HFCAA, whether the PCAOB is unable to inspect or investigate completely registered public accounting firms located in a foreign jurisdiction because of a position taken by one or more authorities in that jurisdiction. On December 2, 2021, the SEC adopted amendments to finalize rules implementing the submission and disclosure requirements in the HFCAA. The rules apply to registrants the SEC identifies as having filed an annual report with an audit report issued by a registered public accounting firm that is located in a foreign jurisdiction and that the PCAOB is unable to inspect or investigate (the “Commission-Identified Issuers”). The final amendments require Commission-Identified Issuers to submit documentation to the SEC establishing that, if true, it is not owned or controlled by a governmental entity in the public accounting firm’s foreign jurisdiction. The amendments also require that a Commission-Identified Issuer that is a “foreign issuer,” as defined in Exchange Act Rule 3b-4, provide certain additional disclosures in its annual report for itself and any of its consolidated foreign operating entities. Further, the amendments provide notice regarding the procedures the SEC has established to identify issuers and to impose trading prohibitions on the securities of certain Commission-Identified Issuers, as required by the HFCAA. A Commission-Identified Issuer will be required to comply with the submission and disclosure requirements in the annual report for each year in which it was identified. If we are identified as a Commission-Identified Issuer based on our annual report for the fiscal year ended December 31, 2021, we will be required to comply with the submission or disclosure requirements in our annual report filing covering the fiscal year ended December 31, 2022. If we are identified as a Commission-Identified Issuer for three consecutive years based on our annual reports for fiscal years 2021, 2022 and 2023, the SEC would prohibit our securities from trading on a securities exchange or in the over the counter trading market in the United States the earliest in early 2024. While we understand that there has been dialogue among the CSRC, the SEC and the PCAOB regarding the inspection of PCAOB-registered accounting firms in China, but there is no certainty that any agreement will be reached.

The SEC may propose additional rules or guidance that could impact us if our auditor is not subject to PCAOB inspection. For example, on August 6, 2020, the President’s Working Group on Financial Markets, or the PWG, issued the Report on Protecting United States Investors from Significant Risks from Chinese Companies to the then President of the United States. This report recommended the SEC implement five recommendations to address companies from jurisdictions that do not provide the PCAOB with sufficient access to fulfil its statutory mandate. Some of the concepts of these recommendations were implemented with the enactment of the HFCAA. However, some of the recommendations were more stringent than the HFCAA. For example, if a company was not subject to PCAOB inspection, the report recommended that the transition period before a company would be delisted would end on January 1, 2022.

The SEC has announced that the SEC staff is preparing a consolidated proposal for the rules regarding the implementation of the HFCAA and to address the recommendations in the

PWG report. The implications of possible additional regulation in addition to the requirements of the HFCAA and what was recently adopted on December 2, 2021 are uncertain. Such uncertainty could cause the market price of our ADSs to be materially and adversely affected, and our securities could be delisted or prohibited from being traded “over-the-counter” earlier than would be required by the HFCAA. If our securities are unable to be listed on another securities exchange by then, such a delisting would substantially impair your ability to sell or purchase our ADSs when you wish to do so, and the risk and uncertainty associated with a potential delisting would have a negative impact on the price of our ADSs.

In addition, inspections of other firms that the PCAOB has conducted outside the PRC have identified deficiencies in those firms’ audit procedures and quality control procedures, which may be addressed as part of the inspection process to improve future audit quality. The PCAOB’s inability to conduct full inspections in the PRC prevents it from fully evaluating the audits and quality control procedures of our independent registered public accounting firm. As a result, we and investors in our ADSs or common shares are deprived of the benefits of such PCAOB inspections. Furthermore, the inability of the PCAOB to conduct full inspections of auditors in the PRC makes it more difficult to evaluate the effectiveness of our independent registered public accounting firm’s audit procedures or quality control procedures as compared to auditors outside of the PRC that are subject to the PCAOB inspections, which could cause our investors and potential investors to lose confidence in our auditor’s audit procedures and our reported financial information and the quality of the consolidated financial statements.

|

9. |

We note your proposed disclosure in response to comment 13. Please update your response to acknowledge and address that new rules will go into effect on February 15 that require internet companies holding the data of more than 1 million users to undergo a network security review before listing overseas. Elaborate upon whether the availability of these rules changes your belief that you and your VIE are not subject to a cybersecurity review. |

In light of your comment above, the Company will use the below revised disclosures in its 2021 Form 20-F, with necessary updates based on the changes of facts or regulations by then, if any:

Failure to comply with regulations relating to information security and privacy protection, breaches or perceived breaches of our security measures relating to our service offerings, unauthorized disclosure or misuse of personal data through breaches of our computer systems or otherwise, could result in negative publicity and loss of students, expose us to protracted and costly litigation, and harm our business and results of operations. Additionally, it is unclear whether we will be subject to the oversight of the CAC and how such oversight may impact us.

The PRC regulatory and enforcement regime with regard to data security and data protection has also been evolving rapidly in recent years. In July 2013, the China’s Ministry of Industry and Information Technology (and its predecessors), or MIIT, promulgated the Provisions on Protection of Personal Information of Telecommunication and Internet Users to regulate the collection and use of users’ personal information in the provision of telecommunication services and internet information services in China. In November 2016, the National People’s Congress Standing Committee promulgated the Cyber Security Law,

which took effect on June 1, 2017, to protect cyberspace security and order. The Cyber Security Law tightens control of cyber security and sets forth various security protection obligations for network operators. According to the Cyber Security Law, network operators shall, among others, take security measures to protect networks from unauthorized interference, damage and unauthorized access to prevent data from being divulged, stolen or tampered with. Since 2019, the CAC and other relevant authorities further issued detailed implementation rules and measures to refine these information security and privacy protection related regulations. On August 20, 2021, the Standing Committee of the National People’s Congress promulgated the Personal Information Protection Law, which took effects on November 1, 2021. The Personal Information Protection Law aims at protecting personal information rights and interests, regulating the processing of personal information, ensuring the orderly and free flow of personal information in accordance with the law, and promoting the reasonable use of personal information. Our business is facing and/or may face significant challenges regarding information security and privacy protection, particularly with regard to the collection, storage, transmission and sharing of confidential information, among others. As part of our service offerings, we may collect, process, transmit and store the personal information of students. We have adopted various security measures pertaining to the collection, processing, transmission or storage of user information, and have not experienced any material cyber-attacks on our cyber systems. We cannot assure you, however, that our current security measures will be adequate or sufficient to prevent any theft, misuse, or unauthorized interference, damage, or unauthorized or inappropriate disclosure of personal data of our students. In case of any misuse of information collected from our students or any unauthorized interference, damage, or unauthorized or inappropriate disclosure of such information due to our failure to protect it, we could be subject to negative publicity, liability or regulatory penalties. Any such negative publicity, liability or regulatory penalties could cause us to lose students, expose us to costly litigation and have a material adverse impact on our business and results of operations.

On July 1, 2015, the National People’s Congress Standing Committee promulgated the National Security Law (the “New National Security Law”), which took effect on the same date and replaced the former National Security Law promulgated in 1993. Under the New National Security Law, we are obligated to safeguard national security by, for example, providing evidence related to activities endangering national security, providing assistance for national security work and providing necessary support for national security institutions, public security institutions and military institutions. As such, we may have to provide data to PRC government authorities and military institutions to ensure compliance with the New National Security Law. Complying with such regulations could cause us to incur substantial costs, require us to change our data practices in a manner adverse to our business, or even subject us to negative publicity which could harm our reputation with users and negatively affect our business operations and the trading price of our ADSs.

On December 28, 2021, the CAC published the Cybersecurity Review Measures, which became effective on February 15, 2022. Under the Cybersecurity Review Measures, critical information infrastructure operators purchasing network products and services and internet platform operators engaging in data processing activities that affect or may affect national security shall be subject to cybersecurity review. The Cybersecurity Review Measures further require that any internet platform operator applying for listing on a foreign exchange must go through cybersecurity review if it possesses personal information of more than one million users. The review focuses on several factors, including, among others, (i) the risk

of theft, leakage, corruption, illegal use or export of any core or important data, or a large amount of personal information, and (ii) the risk of any critical information infrastructure, core or important data, or a large amount of personal information being affected, controlled or maliciously exploited by a foreign government after a company is listed. We believe we would not be subject to the cybersecurity review by the CAC, given that: (i) we do not possess a large amount of personal information in our business operations; and (ii) data processed in our business does not have a bearing on national security and thus may not be classified as core or important data by the authorities. However, we cannot assure you that PRC regulatory agencies, including the CAC, would take the same view as we do, and there remains uncertainty as to how the Cybersecurity Review Measures will be interpreted or implemented and whether the PRC regulatory agencies, including the CAC, may adopt new laws, regulations, rules, or detailed implementation and interpretation related to the Cybersecurity Review Measures. In the event that we are subject to any mandatory cybersecurity review and other specific actions required by the CAC, we will face uncertainty as to whether any clearance or other required actions can be timely completed, or at all. Given such uncertainty, we may be further required to suspend our relevant business, shut down our website, or face other penalties, which could materially and adversely affect our business, financial condition, and results of operations, and/or the value of our ADSs or could significantly limit or completely hinder our ability to offer or continue to offer securities to investors. As of the date hereof, we have not received any notice from such authorities requiring us to going through cybersecurity review by the CAC.

On November 14, 2021, the CAC publicly solicited opinions on the Regulations on the Administration of Cyber Data Security for public comments (the “Draft Data Security Regulations”), which reiterates that data processors that handle personal information of more than one million people intending to be listed abroad should apply for a cybersecurity review. As the Draft Data Security Regulations have not been adopted, it remains unclear whether the formal version to be adopted in the future will have any further material changes, and it is uncertain how the measures will be enacted, interpreted, or implemented; including how they will affect us.

Index to Consolidated Financial Statements

Note 1. Description of Business, Organization and Significant Concentrations and Risks

VIE Agreements, page F-13

|

10. |