20-F: Annual and transition report of foreign private issuers pursuant to Section 13 or 15(d)

Published on June 29, 2017

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

|

o |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

OR | |

|

|

|

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

OR | |

|

|

|

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

OR | |

|

|

|

|

o |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report . . . . . . . . . . . . . . . . . . .

For the transition period from to

Commission file number: 001-33910

|

ATA Inc. |

|

(Exact name of Registrant as specified in its charter) |

|

|

|

Not applicable |

|

(Translation of Registrants name into English) |

|

|

|

Cayman Islands |

|

(Jurisdiction of incorporation or organization) |

|

|

|

1/F East Gate, Building No. 2, Jian Wai Soho, No. 39 Dong San Huan Zhong Road, Chao Yang District, Beijing 100022, China |

|

(Address of principal executive offices) |

|

|

|

Amy Tung Chief Financial Officer ATA Inc. 1/F East Gate, Building No. 2, Jian Wai Soho, No. 39 Dong San Huan Zhong Road, Chao Yang District, Beijing 100022, China Telephone: 8610-6518-1122 Facsimile: 8610-5869-8106 |

|

(Name, Telephone E-mail and/or Facsimile Number and Address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act.

|

Title of each class |

|

Name of each exchange on which |

|

American Depositary Shares, each representing two common shares, par value $0.01 per share |

|

NASDAQ Global Market |

Securities registered or to be registered pursuant to Section 12(g) of the Act. None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. None

Indicate the number of outstanding shares of each of the issuers classes of capital or common stock as of the close of the period covered by the annual report:

|

|

|

|

|

48,482,724 common shares. |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o Yes x No

If this report is an annual or transaction report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of large accelerated filer, accelerated filer, and emerging growth company in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o |

Accelerated filer o |

|

Non-accelerated filer x |

Emerging growth company o |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

The term new or revised financial accounting standard refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

U.S. GAAP x |

|

International Financial Reporting Standards as issued |

|

Other o |

If Other has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

o Item 17 o Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.

o Yes x No

|

|

Page |

|

1 | |

|

2 | |

|

3 | |

|

Item 1. Identity of Directors, Senior Management and Advisors |

3 |

|

3 | |

|

3 | |

|

37 | |

|

69 | |

|

70 | |

|

97 | |

|

110 | |

|

114 | |

|

115 | |

|

116 | |

|

Item 11. Quantitative and Qualitative Disclosures About Market Risk |

126 |

|

Item 12. Description of Securities Other Than Equity Securities |

128 |

|

131 | |

|

131 | |

|

Item 14. Material Modifications to the Rights of Security Holders and Use of Proceeds |

131 |

|

131 | |

|

134 | |

|

134 | |

|

134 | |

|

134 | |

|

Item 16D. Exemptions From the Listing Standards for Audit Committees |

135 |

|

Item 16E. Purchases of Equity Securities by the Issuer and Affiliated Purchasers |

135 |

|

136 | |

|

136 | |

|

137 | |

|

138 | |

|

138 | |

|

138 | |

|

138 | |

|

S-1 |

Except where the context otherwise requires and for purposes of this annual report only:

· All references to years are to the calendar year from January 1 to December 31 and references to our fiscal year or years are to the fiscal year or years ended March 31. On June 1, 2017, our company declared a change in our fiscal year end from March 31 to December 31. We will file a transition report on Form 20-F after December 31, 2017 to account for the transition period from April 1, 2017 to December 31, 2017 to reflect this change. Going forward, all references to our fiscal year or years are to the fiscal year or years ended December 31;

· we, us, our company, our, and ATA refer to ATA Inc. and its subsidiaries as the context requires;

· China, Chinese and PRC refers to the Peoples Republic of China, excluding, for purposes of this annual report only, Taiwan and the Special Administrative Regions of Hong Kong and Macau;

· all references to Renminbi or RMB are to the legal currency of China, and all references to U.S. dollars, dollars, $ or US$ are to the legal currency of the United States;

· U.S. GAAP refers to generally accepted accounting principles in the United States; and

· PRC GAAP refers to generally accepted accounting principles in the Peoples Republic of China.

This annual report on Form 20-F includes our audited consolidated statements of comprehensive income (loss) for the fiscal years ended March 31, 2015, 2016 and 2017 and audited consolidated balance sheets as of March 31, 2016 and 2017. Each of our ADSs represents two common shares. Our ADSs are listed on the Nasdaq Global Market under the symbol ATAI.

This annual report on Form 20-F contains forward-looking statements that are based on our current expectations, assumptions, estimates and projections about us and our industry. All statements other than statements of historical fact in this annual report are forward-looking statements. In some cases, these forward-looking statements can be identified by words and phrases such as may, should, intend, predict, potential, continue, will, expect, anticipate, estimate, plan, believe, is /are likely to or the negative form of these words and phrases or other comparable expressions. The forward-looking statements included in this annual report relate to, among others:

· our goals and strategies;

· our future prospects and market acceptance of our technologies, products and services;

· our future business development and results of operations;

· projected revenues, profits, earnings and other estimated financial information;

· our plans to expand and enhance our products and services;

· competition in the computer-based testing, educational services and online education markets; and

· Chinese laws, regulations and policies, including those applicable to the education industry, Internet content providers, Internet content and foreign exchange.

These forward-looking statements involve various risks, assumptions and uncertainties. Although we believe that our expectations expressed in these forward-looking statements are reasonable, our expectations may turn out to be incorrect. Our actual results could be materially different from our expectations. Important risks and factors that could cause our actual results to be materially different from our expectations are generally set forth in Item 3.D. of this annual report, Key information Risk Factors and elsewhere in this annual report.

The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made in this annual report. All forward-looking statements included herein attributable to us or other parties or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Except to the extent required by applicable laws and regulations, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which the statements are made or to reflect the occurrence of unanticipated events.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

A. Selected Financial Data

Selected Consolidated Financial Data

The following selected consolidated statement of comprehensive income (loss) data for the fiscal years ended March 31, 2015, 2016 and 2017 (other than ADS data) and the selected consolidated balance sheet data as of March 31, 2016 and 2017 are derived from our audited consolidated financial statements included elsewhere in this annual report and should be read in conjunction with such consolidated financial statements and related notes. Our selected consolidated statement of comprehensive income data for the fiscal years ended March 31, 2013 and 2014 (other than ADS data) and the selected consolidated balance sheet data as of March 31, 2013, 2014 and 2015 are derived from our audited consolidated financial statements not included in this annual report. The following information should also be read in conjunction with Item 5. Operating and Financial Review and Prospects. Our audited consolidated financial statements are prepared in accordance with U.S. GAAP.

|

|

|

For the fiscal year ended March 31, |

| ||||||||||

|

|

|

2013 |

|

2014 |

|

2015 |

|

2016 |

|

2017 |

| ||

|

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

US$ |

|

|

|

|

(In thousands, except for share and ADS data) |

| ||||||||||

|

Selected Consolidated Statement of Comprehensive Income (Loss) Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Testing services |

|

335,791 |

|

358,837 |

|

319,055 |

|

384,800 |

|

430,057 |

|

62,479 |

|

|

Online education services |

|

11,343 |

|

5,949 |

|

5,711 |

|

4,897 |

|

7,462 |

|

1,084 |

|

|

Other |

|

19,541 |

|

19,882 |

|

25,392 |

|

27,443 |

|

34,867 |

|

5,066 |

|

|

Total net revenues |

|

366,675 |

|

384,668 |

|

350,158 |

|

417,140 |

|

472,386 |

|

68,629 |

|

|

Gross profit |

|

177,844 |

|

196,188 |

|

177,619 |

|

209,123 |

|

232,533 |

|

33,783 |

|

|

Total operating expenses |

|

150,830 |

|

154,809 |

|

147,938 |

|

157,388 |

|

161,026 |

|

23,394 |

|

|

Income from operations |

|

27,013 |

|

41,379 |

|

31,758 |

|

51,735 |

|

71,507 |

|

10,389 |

|

|

Share of losses of equity method investments |

|

|

|

|

|

(2,197 |

) |

(8,829 |

) |

(16,121 |

) |

(2,342 |

) |

|

Impairment loss of long-term investments |

|

|

|

|

|

|

|

|

|

(32,199 |

) |

(4,678 |

) |

|

Income tax expense |

|

(7,005 |

) |

(19,895 |

) |

(9,575 |

) |

(18,922 |

) |

(38,597 |

) |

(5,607 |

) |

|

Net income (loss) |

|

23,208 |

|

27,276 |

|

23,056 |

|

26,051 |

|

(9,969 |

) |

(1,448 |

) |

|

Net loss attributable to non-controlling interests |

|

|

|

|

|

|

|

|

|

(253 |

) |

(36 |

) |

|

Net income (loss) attributable to ATA Inc. |

|

23,208 |

|

27,276 |

|

23,056 |

|

26,051 |

|

(9,716 |

) |

(1,412 |

) |

|

|

|

For the fiscal year ended March 31, |

| ||||||||||

|

|

|

2013 |

|

2014 |

|

2015 |

|

2016 |

|

2017 |

| ||

|

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

US$ |

|

|

Basic earnings (loss) per common share |

|

0.50 |

|

0.59 |

|

0.49 |

|

0.57 |

|

(0.21 |

) |

(0.03 |

) |

|

Diluted earnings (loss) per common share |

|

0.50 |

|

0.59 |

|

0.49 |

|

0.57 |

|

(0.21 |

) |

(0.03 |

) |

|

Basic earnings (loss) per ADS (1) |

|

1.00 |

|

1.18 |

|

0.98 |

|

1.14 |

|

(0.42 |

) |

(0.06 |

) |

|

Diluted earnings (loss) per ADS (1) |

|

1.00 |

|

1.18 |

|

0.98 |

|

1.14 |

|

(0.42 |

) |

(0.06 |

) |

|

Dividends declared per common share |

|

0.554 |

|

|

|

1.260 |

|

|

|

|

|

|

|

|

Weighted average common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

44,967,823 |

|

45,227,159 |

|

45,597,580 |

|

45,635,186 |

|

45,772,916 |

|

|

|

|

Diluted |

|

45,115,617 |

|

45,231,555 |

|

45,597,580 |

|

45,635,186 |

|

45,772,916 |

|

|

|

(1) Each ADS represents two common shares.

|

|

|

As of March 31, |

| ||||||||||

|

|

|

2013 |

|

2014 |

|

2015 |

|

2016 |

|

2017 |

| ||

|

|

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

US$ |

|

|

|

|

(In thousands) |

| ||||||||||

|

Selected Consolidated Balance Sheet Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

290,030 |

|

311,947 |

|

240,295 |

|

247,668 |

|

222,448 |

|

32,318 |

|

|

Accounts receivable, net |

|

51,115 |

|

68,353 |

|

48,150 |

|

50,552 |

|

56,161 |

|

8,159 |

|

|

Total current assets |

|

354,770 |

|

398,093 |

|

312,951 |

|

316,488 |

|

295,945 |

|

42,995 |

|

|

Restricted cash |

|

|

|

|

|

|

|

|

|

30,000 |

|

4,358 |

|

|

Long term investments |

|

|

|

|

|

35,730 |

|

50,686 |

|

88,892 |

|

12,914 |

|

|

Total assets |

|

457,818 |

|

491,237 |

|

455,244 |

|

470,461 |

|

519,840 |

|

75,523 |

|

|

Deferred revenues, current |

|

7,377 |

|

8,383 |

|

21,743 |

|

16,612 |

|

10,222 |

|

1,485 |

|

|

Total current liabilities |

|

79,568 |

|

77,149 |

|

76,158 |

|

74,352 |

|

103,030 |

|

14,968 |

|

|

Deferred income tax liabilities |

|

|

|

|

|

|

|

|

|

22,621 |

|

3,286 |

|

|

Total liabilities |

|

82,271 |

|

79,345 |

|

77,922 |

|

76,231 |

|

127,383 |

|

18,506 |

|

|

Common shares |

|

3,461 |

|

3,475 |

|

3,514 |

|

3,531 |

|

3,534 |

|

513 |

|

|

Retained earnings (accumulated deficit) |

|

(28,649 |

) |

(1,372 |

) |

21,684 |

|

47,735 |

|

38,019 |

|

5,523 |

|

|

Total shareholders equity attributable to ATA Inc. |

|

375,548 |

|

411,892 |

|

377,322 |

|

394,231 |

|

391,377 |

|

56,860 |

|

|

Non-controlling interests |

|

|

|

|

|

|

|

|

|

1,080 |

|

157 |

|

|

Total shareholders equity |

|

375,548 |

|

411,892 |

|

377,322 |

|

394,231 |

|

392,457 |

|

57,017 |

|

|

|

|

For the fiscal year ended March 31, |

| ||||||||

|

|

|

2013 |

|

2014 |

|

2015 |

|

2016 |

|

2017 |

|

|

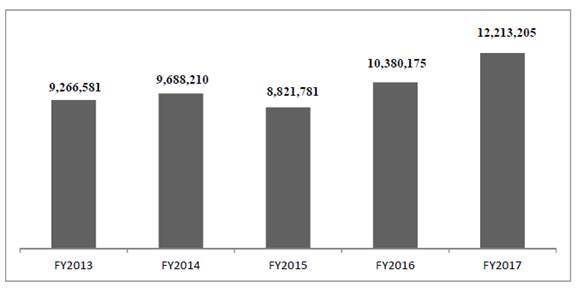

Key Operating Data: |

|

|

|

|

|

|

|

|

|

|

|

|

Number of tests delivered(1) |

|

9,266,581 |

|

9,688,210 |

|

8,821,781 |

|

10,380,175 |

|

12,213,205 |

|

(1) Includes free tests delivered for business development purpose. The number of tests delivered excluding free tests in the fiscal years ended March 31, 2013, 2014, 2015, 2016 and 2017 was 8,744,859, 9,411,226, 8,767,389, 10,258,866 and 12,127,203, respectively.

Exchange Rate Information

We conduct our business primarily in China and a substantial majority of our revenues and expenses are denominated in Renminbi. The conversion of Renminbi into U.S. dollars in this annual report is based on the noon buying rate in The City of New York for cable transfers of Renminbi per U.S. dollar certified for customs purposes by the Federal Reserve Bank of New York, as set forth in the H.10 weekly statistical release of Federal Reserve Board. Unless otherwise noted, all translations from Renminbi to U.S. dollars in this annual report were made at a rate of RMB 6.8832 to US$1.00, which was the noon buying rate in effect as of March 31, 2017. The noon buying rate on June 22, 2017 was RMB 6.8275 to US$1.00. We make no representation that any Renminbi or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or Renminbi, as the case may be, at any particular rate, the rates stated below, or at all. The Chinese government restricts or prohibits the conversion of Renminbi into foreign currency and foreign currency into Renminbi for certain types of transactions.

The following table sets forth information concerning exchange rates between the Renminbi and the U.S. dollar for the periods indicated. These rates are provided solely for your convenience and are not necessarily the exchange rates that we used in this annual report.

|

|

|

Renminbi per U.S. Dollar Noon Buying Rate |

| ||||||

|

|

|

Average (1) |

|

High |

|

Low |

|

Period-end |

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal year ended March 31, 2013 |

|

6.2783 |

|

6.2105 |

|

6.3879 |

|

6.2108 |

|

|

Fiscal year ended March 31, 2014 |

|

6.1220 |

|

6.0402 |

|

6.2273 |

|

6.2164 |

|

|

Fiscal year ended March 31, 2015 |

|

6.1952 |

|

6.1107 |

|

6.2741 |

|

6.1990 |

|

|

Fiscal year ended March 31, 2016 |

|

6.3584 |

|

6.1927 |

|

6.5932 |

|

6.4480 |

|

|

Fiscal year ended March 31, 2017 |

|

6.7425 |

|

6.4571 |

|

6.9580 |

|

6.8832 |

|

|

Most recent six months: |

|

|

|

|

|

|

|

|

|

|

December 2016 |

|

6.9198 |

|

6.8771 |

|

6.9580 |

|

6.9430 |

|

|

January 2017 |

|

6.8907 |

|

6.8360 |

|

6.9575 |

|

6.8768 |

|

|

February 2017 |

|

6.8694 |

|

6.8517 |

|

6.8821 |

|

6.8665 |

|

|

March 2017 |

|

6.8940 |

|

6.8687 |

|

6.9132 |

|

6.8832 |

|

|

April 2017 |

|

6.8876 |

|

6.8778 |

|

6.8988 |

|

6.8900 |

|

|

May 2017 |

|

6.8843 |

|

6.8098 |

|

6.9060 |

|

6.8098 |

|

|

June 2017 (period through June 22, 2017) |

|

6.8063 |

|

6.7888 |

|

6.8285 |

|

6.8275 |

|

Source: H.10 weekly statistical release of the Federal Reserve Board

(1) Annual averages are calculated using the exchange rates for the last day of each month during the relevant year. Monthly averages are calculated using daily exchange rates during the relevant month.

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Risks Relating to Our Business

A limited number of our clients have accounted for and are expected to continue to account for a high percentage of our revenues. The loss of or significant reduction in orders from any of these clients could significantly reduce our revenues and have a material adverse effect on our results of operations.

Our three largest clients in the fiscal year ended March 31, 2017, the Chinese Institute of Certified Public Accountants, or the CICPA, the Asset Management Association of China, or the AMAC, and the China Banking Association, or CBA, accounted for 19.1%, 18.6% and 11.8%, respectively, of our net revenues in that period. We provide both computer-based testing and test administration services to our three largest clients. We generated RMB 233.6 million ($33.9 million) from our services to CICPA, AMAC and CBA in the fiscal year ended March 31, 2017.

As of March 31, 2017, our gross accounts receivable from CICPA, AMAC and CBA were RMB 0.5 million ($0.1 million), RMB 10.8 million ($1.6 million) and RMB 2.1 million ($0.3 million), respectively.

Due to our dependence on a limited number of clients, any one of the following events, among others, could cause material fluctuations or declines in our revenues and have a material adverse effect on our financial condition or results of operations:

· a reduction, delay or cancellation of contracts or product or service orders from one or more of our major clients;

· a delay in paying or failure to pay outstanding accounts receivable;

· a decision by one or more of our major clients to award contracts or orders to one of our competitors; and

· a decision by one or more of our major clients to significantly reduce the price they are willing to pay for our services or products.

Any of these events could occur due to causes outside of our control, such as macro-economic conditions, changes in a clients management or the personnel with whom we interact, changes in technology, the actions of our competitors, changes in governmental regulations and policies and changes in a clients budgeting or financial prospects.

Our financial results are subject to fluctuations and seasonality related to the revenue cycles for our products and services. Our relatively long and unpredictable sales cycle and other factors beyond our control may decrease our revenues in a particular period. As a result, it is difficult for us to predict our results of operations and you should not rely on our historical operating results as an indication of our future financial performance.

Our results of operations have varied in the past from period to period, and are likely to vary in the future, due to the fact that a substantial portion of our sources of revenues are seasonal. We have experienced seasonality and expect in the future to continue to experience seasonality in net revenues and accounts receivable related to our test delivery services, with the quarters ending June 30 and December 31 typically having higher net revenues from testing services and the quarters ending September 30 and March 31 typically having lower net revenues from testing services. This is primarily because the tests from which we derive substantial revenues are mostly delivered in the quarters ending June 30 and December 31. Test timing can be a major contributing factor to quarterly fluctuations of financial results. For example, we generated revenues of RMB 273.5 million in the quarter ended December 31, 2016 as compared to RMB 65.1 million in the quarter ended September 30, 2016, primarily because one of our major test sponsors, CICPA, held tests during the third quarter of fiscal year ended March 31, 2017.

In addition, our sales cycles are generally long and unpredictable. A clients decision to purchase our products and services often involves a lengthy evaluation process. Throughout the sales cycle, we often spend considerable time educating and providing information to prospective clients regarding the use and benefits of our products and services. Moreover, budget constraints and the need for multiple approvals within large enterprises, governmental agencies and educational institutions may also delay purchasing decisions. As a result, the sales cycle for our services may last a year or longer. Such a lengthy sales cycle, and any future increases in our sales cycle, could lead to higher sales and marketing expenses and adversely affect our cash flow from operations. In addition, the lengthy sales cycle has made, and may continue to make, our financial results prone to fluctuations or decrease our revenues in a particular period.

If our revenues for a particular quarter are lower than we expect, we may be unable to reduce our operating expenses for that quarter by a corresponding amount, which could negatively affect our operating results for that quarter. As a result, you should not rely on our quarter-to-quarter comparisons of our operating results as indicators of likely future performance. Our operating results may be below the expectations of public market analysts and investors in one or more future quarters. If that occurs, the market price of our ADSs could decline and you could lose part or all of your investment. Fluctuations of our quarterly financial results may also lead to increased volatility in the market price of our ADSs.

The market for our services in China is still emerging and evolving rapidly. If market acceptance of our services declines or fails to grow, our revenue growth may slow or we may experience a decrease in revenues.

As the market for our services in China is still emerging and evolving rapidly, our success will depend to a large extent on our ability to convince our clients that our technologies and services are valuable and that it is more cost-effective for them to utilize our services than for them to develop similar services in-house.

We must address the following concerns, among others, with our clients as they decide to implement our computer-based testing services to use our technologies and services:

· concern over the commitment of time, personnel and funding necessary to implement our computer-based testing services;

· ability of clients to develop their own computer-based testing services;

· possible perceived security and academic integrity risks associated with computer-based testing services and third-party curriculum providers; and

· reluctance of the academic community to adopt computer-based learning materials and computer-based tests.

A decline in the demand for computer-based testing services by test sponsors could negatively affect demand for our computer-based testing services and technologies. Even if demand for computer-based testing services continues to grow, this demand may not grow as quickly as we anticipate. If market acceptance of our services declines or fails to grow, our revenue growth may slow or we may experience a decrease in revenues.

The markets for our new service offerings are still new and unpredictable. If we cannot succeed in adapting to client needs in the new markets or effectively addressing risks associated with this expansion, our revenue growth may slow and our reputation may be negatively affected.

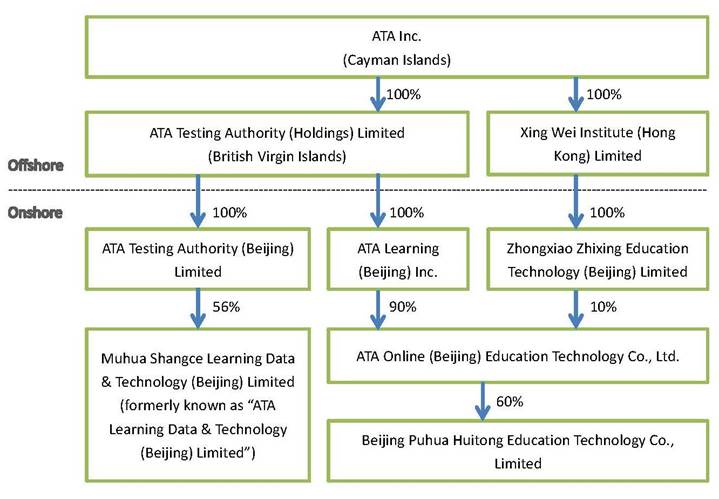

We have allocated, and intend to continue to allocate, time, effort and capital to expand our service offerings, and test-delivery systems, such as our proprietary mobile test administration platform called the Mobile Testing Service, or MTS, which we launched in 2013, and our new patented online testing platform, EzTest, which we launched in 2015. In November 2013, we completed our acquisition of Xing Wei Institute (Hong Kong) Limited, or Xing Wei, a private education technology company that provides training solutions as well as online and mobile training platforms for corporations in China, to expand our service offering with respect to training and consulting for corporations. In August 2014, we and the New Oriental Education & Technology Group formed a joint venture to provide online and mobile education solutions to growing base of professionals in China. In December 2014, we made a strategic investment in Master Mind Education Company, or Master Mind, which marks our expansion into Chinas K-12 education market. In January 2015, we made a strategic investment in Beijing Satech Internet Educational Technology Ltd., or Satech, which marks our expansion into SAT exam-related training market. With the aim of continuing to expand in the overseas education market, we subsequently increased our investment in Satech in April 2016. In September 2015, we made another strategic investment in Brilent Inc., or Brilent, which we expect to offer our clients with services that improve the effectiveness of selecting the most suitable individual for their job openings. To diversify our service offerings and explore further growth opportunities, we continued to make a number of strategic investments in the fiscal year ended March 31, 2017. In April 2016, we made a strategic investment in Beijing Empower Education Online, Co., Ltd., or EEO, an online education company that operates web-based virtual classroom platforms in China, to further increase our business efforts in online learning and the K-12 education market. In May 2016, we made a strategic investment in Medicine (Beijing) Education Technology Ltd., a China-based online education technology company focused on providing training and exam preparation services in the specialty niche sectors of medicine, pharmacy and healthcare. In June 2016, we made a strategic investment in ApplySquare Education & Technology Co., Ltd., which signals our entry into the Chinese higher education market. In July 2016, we made a strategic investment in Beijing GlobalWisdom Information Technology Co., Ltd., through which we expect to explore growth opportunities in Chinas online language education market. In September 2016, we made a strategic investment in Beijing Puhua Huitong Education Technology Co., Limited to further increase our penetration into the adult continuing education market. In February 2017, we entered into a partnership with Nantong MOOC-CN Investment Center (Limited Partnership), or MOOC-CN Investment, pursuant to which MOOC-CN Investment agreed to make a strategic investment to help us expand into the K-12 education assessment market, with particular focus on the development of K-12 education assessment tools and content. In May 2017, we made an additional investment of RMB 5.5 million ($0.8 million) in EEO, while our equity interest in EEO remained unchanged. As the markets for these offerings are relatively new for us, we cannot assure you that we will succeed in adapting to client needs in these markets or effectively addressing risks associated with this expansion. In the fiscal year ended March 31, 2017, we recorded impairment loss of RMB 32.2 million ($4.7 million) related to these investments in certain companies providing K-12 related online education services, which failed to meet the expected milestones and operation forecasts and encountered shortage of working capital resulted from continuous negative operating cash flows.

It may be difficult for us to accurately predict demand for these and other new service offerings we develop. Furthermore, the PRC government may enact unforeseen regulations and policies that could limit our ability to provide or expand certain services, such as prohibitions on foreign-invested entities engaging in certain businesses. Additional risks that we face expanding in these markets include the following:

· we may underestimate the amount of capital, personnel and other resources required to carry out our expansion plans, which may affect the success of our expansion and/or negatively impact the quality of our other product and service offerings;

· if we are unsuccessful in the relevant new market, it may negatively affect our reputation and the status of our brand in other markets;

· we may fail to develop sufficient payment collection, technical support and other administrative capabilities necessary to successfully develop and manage our new service offerings on an increasingly large scale; and

· we have recorded impairment loss relating to certain strategic investments and may continue to incur additional impairment loss associated with our future investments which may adversely affect our financial condition and results of operations.

If we fail to maintain our relationship with major test sponsors, our revenue growth may slow or we may experience a decrease in revenues.

The success of our service offerings depends on our ability to gain and maintain relevant business relationships, such as our relationship with major test sponsors for computer-based tests in China, our relationship with the licensor of certain test titles, and our relationship with Saville Assessment in relation to psychometric tests for our HR Select employee assessment solution. Factors that are beyond our control may cause our relationship with relevant parties to change. For example, our exclusive Test of English for International Communication, or TOEIC distributor contract ended on February 28, 2014 due to ETS decision to change its distribution model. Although we are still a distributor and administrator of TOEIC exams in China and signed a non-exclusive distributor contract with ETS on June 23, 2014 (which was subsequently extended on January 20, 2017) to continue delivery of certain TOEIC exams to our existing institutional clients until December 31, 2019, we had lost a majority of the revenues generated from administering TOEIC exams due to contractual limitations on the scope of TOEIC exam services to selected market segments in China. If we fail to maintain our relationship with major test sponsors, our revenue growth may slow or we may experience a decrease in revenues.

Failure to comply with the regulations relating to information security and privacy protection, such as breaches or perceived breaches of our security measures relating to test collection, scoring and storage, unauthorized disclosure or misuse of personal data through breach of our computer systems or otherwise, could result in negative publicity and clients loss, expose us to protracted and costly litigation, and harm our business and results of operations.

The internet industry is facing significant challenges regarding information security and privacy protection, particularly with regard to the collection, storage, transmission and sharing of confidential information, among others. As part of our service offerings, we collect, process, transmit and store highly confidential information, including personal information and test questions, answers and scores. We are required under PRC law to maintain the security and confidentiality of the information we handle as part of our testing services, which is also essential to protecting the integrity and accuracy of the test taking process and retaining our client base. In December 2012, the Standing Committee of the PRC National Peoples Congress promulgated the Decision on Strengthening Network Information Protection, or the Network Information Protection Decision, to enhance the legal protection of information security and privacy on the internet. The Network Information Protection Decision specifically requires internet operators to take security measures to ensure confidentiality of information of users. We have adopted various security measures pertaining to the collection, processing, transmission or storage of user information. Any breach or perceived breach in our security measures as a result of third-party action, employee error, and malfeasance or otherwise, or any instances or claims of cheating on tests that we administer could result in liability claims and have a negative impact on our reputation.

The PRC regulatory and enforcement regime with regard to data security and data protection has also been evolving rapidly in recent years. On July 1, 2015, the National Peoples Congress Standing Committee promulgated the National Security Law, or the New National Security Law, which took effect on the same date and replaced the former National Security Law promulgated in 1993. Under the New National Security Law, we are obligated to safeguard national security by, for example, providing evidence related to activities endangering national security, providing convenience and assistance for national security work, and providing necessary support and assistance for national security institutions, public security institutions as well as military institutions. As such, we may have to provide data to the PRC government authorities and military institutions to ensure compliance with the New National Security Law. Complying with such regulations could cause us to incur substantial costs, require us to change our data practices in a manner adverse to our business, or even subject us to negative publicity which could harm our reputation with users and negatively affect our business operations and the trading price of our ADSs. In addition, in November 2016, the National Peoples Congress Standing Committee promulgated the Cyber Security Law, which took effect on June 1, 2017, to protect cyberspace security and order. The Cyber Security Law tightens control of cyber security and sets forth various security protection obligations for network operators. According to the Cyber Security Law, network operators shall, among others, take security measures to protect the network from unauthorized interference, damage and unauthorized access and prevent data from being divulged, stolen or tampered with. In case of any misuses of information collected from our clients or students or any unauthorized interference, damage, or unauthorized or inappropriate disclosure of such information due to our failure to protect it, we could be subject to negative publicity, liability claims or regulatory penalties. Any such negative publicity, liability claims or regulatory penalties could cause us to lose clients, expose us to costly litigation and have a material adverse impact on our business and results of operations.

If certain tests are not allowed to be administered in China due to cheating fears, our revenue growth may slow or we may experience a decrease in revenues.

We administered a number of international tests in China, such as TOEIC. In recent years, academic cheating has been frequently reported to occur in the international tests. These tests may be canceled by their owners due to cheating fears. If certain tests that we are administering are not allowed to be taken in China, our revenue growth may slow or we may experience a decrease in revenues.

Reductions in public funding available to our clients that are governmental agencies could adversely impact demand by these agencies and institutions for our products and services.

We derive a significant portion of our total net revenues from licensing and service fees from Chinese governmental agencies. Demand and ability to pay for our products and services by these agencies are affected by government budgetary cycles, funding availability and government policies. Funding reductions, reallocations or delays could adversely impact demand for our products and services by our clients or reduce the fees these clients are willing to pay for our products and services.

A significant portion of our revenues are dependent on market acceptance of our E-testing platform and other computer-based testing technologies, and if we are unable to anticipate and meet our clients technological needs and challenges from new technologies and industry standards, our products and services may lose market acceptance or become obsolete, and our margins and results of operations may be adversely affected.

Our advanced technologies for the creation and delivery of computer-based tests, including our E-testing platform and our performance-based testing technologies, are a key factor in growing and maintaining our relationships with test sponsors, educational institution clients and educational program content providers. Our future success depends on our ability to upgrade our systems, develop new technologies and anticipate and meet the technical needs of our clients on a regular basis. The emergence in the market of new test creation and delivery technologies or substitute products and services could reduce our competitiveness or render our current technologies and services obsolete. Moreover, if other companies develop similar technologies offering functionality comparable to that of our technologies, pricing pressure may increase and our margins and results of operations may be adversely affected. Additionally, industry standards such as standard interfaces and data exchange protocols may be developed for testing technologies, and if these industry standards are incompatible with our technologies, demand for our technologies, products and services may decline significantly. To the extent we are unable to maintain our market leadership position in key testing technologies or anticipate and respond to technological developments and changes in industry standards in a timely and cost-effective manner, our products and services may lose market acceptance or become obsolete.

Technical errors or failures in relation to computer-based tests delivered through our test delivery platform could result in negative publicity, loss of clients, liability claims and costly and disruptive litigation.

Due to the complexity of the technologies we use to create and deliver computer-based tests for our clients, technical errors or failures may occur in relation to these services. These may include errors, failures or bugs in our software applications and test security technologies, breakdowns or failures of our servers and computer networks, and connectivity failures between our networks. While we have not experienced major problems to date due to errors, breakdowns, failures, bugs or defects, we cannot assure you that we will not experience such problems in the future. If such a problem were to occur, it could disrupt or compromise the integrity of the test taking process or of test content and results, which could lead to negative publicity and loss of clients and may subject us to liability claims. Although we have established a formal crisis management system to respond to technical problems, it has never been tested in a real crisis situation. Any litigation or negative publicity resulting from an error or failure, with or without merit, could result in substantial costs and divert managements attention and resources from our business and operations.

If we fail to maintain a strong brand, our business may not grow and our financial results may be adversely impacted.

We believe that maintaining and enhancing the value of the ATA brand is important to attracting clients. Our success in maintaining brand awareness will depend on our ability to consistently provide high quality, value-adding, user-friendly and secure products and services. As we expand our product and service offerings, we are increasing our efforts to establish a wider recognition of the ATA brand. To establish a wider recognition of our ATA brand among test takers, test sponsors and companies, we may need to spend significant resources on advertising. As we have limited experience with advertising and other activities required to establish a widely recognized brand, we cannot assure you that we will effectively allocate our resources for these activities or succeed in maintaining and broadening our brand recognition and appeal. If we fail to maintain a strong brand, our business may not grow and our financial results may be adversely impacted.

Actions by our authorized test centers could lead to damage to our brand and reputation, which could cause us to incur substantial costs and strain our relationships with our clients.

As of March 31, 2017, we had contractual relationships with 3,147 authorized test centers. We do not own these centers and their employees are not our employees. Under our contracts with these test centers, we require them to provide sufficient facilities to properly administer computer-based tests and to follow prescribed guidelines for facility maintenance and test administration. We also conduct regular reviews of their facilities and operations and provide consulting services on test administration. However, our contractual arrangements with the test centers provide us with only limited ability to oversee their activities, and most test centers engage in other activities, such as serving as classrooms, when not administering tests. If a test center were to engage in unauthorized or unlawful conduct, whether related to administering computer-based tests or otherwise, our clients, prospective clients and the general public may associate this conduct with our brand, and negative publicity associated with this conduct could harm our reputation and lessen overall demand for computer-based testing services. Furthermore, our business may also be adversely affected if our authorized test centers do not maintain their premises, administer our computer-based tests, or hire qualified personnel and train them properly in a manner consistent with our standards and requirements. In addition, a liability claim against an ATA authorized test center or any center personnel may result in unfavorable publicity for us, our products and services and our other test centers, and could damage our brand and reputation, whether or not the claim is successful. While we may terminate our contracts and relationships with our authorized test centers if any of these events were to occur, we may not be able to identify problems or take action quickly enough to prevent harm to our reputation.

We depend on our key personnel and our business may be severely disrupted if we lose their services and are unable to replace them.

Our future success is dependent upon the continued services of our key executives, as we rely on their industry experience and expertise in our business operations. In particular, we rely heavily on Kevin Xiaofeng Ma, our chairman and chief executive officer for his business vision, management skills, technical expertise, experience in the testing, IT and education industries and working relationships with many of our clients, shareholders and other participants in the testing, IT and education industries. If Mr. Ma is unable or unwilling to continue in his present positions, or if he joined a competitor or formed a competing company in violation of his employment agreement, we may not be able to replace him easily and our business may be severely disrupted.

We may face increasing competition from international and domestic competitors. If we fail to successfully compete, our revenues and market share may decrease, and our results of operations may be adversely affected.

As our business and markets continue to expand, we will face increasing competition, including competition from new entrants, both domestic and international, who will try to gain market share from us. Competitors may introduce new technologies, products and services that have better performance, offer lower prices and gain broader acceptance than our technologies, products and services. Such new products may reduce the overall market for our products and services.

In the computer-based testing services market, we compete primarily on the basis of technology, price, management experience, established infrastructure, reputation and brand. In the future, as more companies enter this market, we believe pricing may become increasingly competitive as well. For our HR Select employee assessment solution, while there are other companies providing services to corporate human resources departments, we are differentiated by our focus on offering more professional testing services with proprietary testing technologies. Traditional Chinese test preparation material providers, such as publishing companies, indirectly compete with our online education services. Increased competition could cause us to lose clients or make it necessary for us to reduce our prices in order to retain our clients, which may negatively affect our revenues and results of operations.

We may not be able to attract and retain the highly skilled employees we need to support our planned growth.

Due to intense market competition for highly skilled workers, we have faced difficulties locating experienced and skilled personnel in certain areas, such as administration, marketing, product development, sales, finance and accounting. In particular, we have had difficulty finding personnel with experience in the computer-based testing services market. We cannot assure you that we will be able to attract or retain the key personnel that we will need to achieve our business objectives. Even if we can identify qualified candidates, they may be subject to non-competition agreements with their prior employers that prevent us from hiring them. In addition, we cannot assure you that we will be able to retain our current skilled personnel. According to our contracts with our employees, all of our employees are prohibited from engaging in any activities that compete with our business during the period of their employment and for two years after termination of their employment with us. Furthermore, all employees are prohibited, for a period of two years following termination, from soliciting other employees to leave us and, for a period of five years following termination, from soliciting our existing clients. However, we may have difficulty enforcing these non-competition and non-solicitation provisions in China because the Chinese legal system, especially with respect to the enforcement of such provisions, is still developing.

Many of our contracts with governmental agencies and public educational institutions take the form of framework agreements and offer little contractual or legal protections, and it may be impractical for us to pursue or obtain legal remedies against these clients.

Many governmental agencies and other public sector entities in China require the use of simple framework agreements for the procurement of products and services from us that lack many of the detailed aspects of our business arrangement. For example, the terms of service may lack the clarity we would normally have in our contracts with commercial enterprises, or contract terms protecting our intellectual property may not be as clear and detailed as we would normally have in our contracts with commercial enterprises. Moreover, it may not be feasible or practicable for us to take legal action against our government and public sector clients to enforce our contractual rights. As a result, we may lack the same contractual or legal protections, or ability to enforce such protections, that we would normally have under the contracts we typically enter into with our other clients.

Unauthorized use of our intellectual property by third parties, including infringement of our ATA brand, and the expenses incurred in protecting our intellectual property rights, may adversely affect our business.

Our copyrights, trademarks, trade secrets, patents and other intellectual property are important to our success. In particular, we believe that our ATA brand name represents a valuable asset as we have sought to gain a reputation for high quality and secure testing services and advanced testing technologies within our markets. Unauthorized use of any of our intellectual property may adversely affect our business and reputation. We rely on trademark, patent, and copyright law, trade secret protection and confidentiality agreements with our employees, clients, business partners and others to protect our intellectual property rights. Nevertheless, it may be possible for third parties to obtain and use our intellectual property without authorization. The unauthorized use of intellectual property is common and widespread in China and enforcement of intellectual property rights by Chinese regulatory agencies is inconsistent. Moreover, litigation may be necessary in the future to enforce our intellectual property rights. Future litigation could result in substantial costs and diversion of our managements attention and resources, and could disrupt our business, as well as have a material adverse effect on our financial condition and results of operations. Given the relative unpredictability of Chinas legal system and potential difficulties enforcing a court judgment in China, there is no guarantee that we would be able to halt the unauthorized use of our intellectual property through litigation.

We may be subject to intellectual property infringement claims, which may force us to incur substantial legal expenses and, if determined adversely against us, may materially disrupt our business.

We cannot assure you that our business operations, in particular, our software, trademarks, know-how and other technologies do not or will not infringe upon patents, valid copyrights or other intellectual property rights held by third parties. We may become subject to legal proceedings and claims from time to time relating to the intellectual property of others in the ordinary course of our business. For example, we have been unable to register our ATA trademark with the China Trademark Office due to similarity with other marks. Although we have not received notice of trademark infringement claims since we began using the mark in 1999 and believe that the risk of litigation is remote, we may be subject to such claims in the future. If we are found to have violated the intellectual property rights of others, we may be enjoined from using such intellectual property, and we may incur licensing fees or be forced to develop alternatives. In addition, we may incur substantial expenses, and may be forced to divert management and other resources from our business operations, to defend against these third-party infringement claims, regardless of their merit. Successful infringement or licensing claims against us may result in substantial monetary liabilities or may materially disrupt the conduct of our business by restricting or prohibiting our use of the intellectual property in question.

Because there is limited business insurance coverage in China, any business disruption or litigation we experience might result in our incurring substantial costs and diverting significant resources to handle such disruption or litigation.

The insurance industry in China is not fully developed. Insurance companies in China offer limited business insurance products. While business disruption insurance may be available to a limited extent in China, we have determined that the risks of disruption and the difficulties and costs associated with acquiring such insurance render it commercially impractical for us to have such insurance. As a result, we do not have any business liability, disruption or litigation insurance coverage for our operations in China. Any business disruption or litigation might result in our incurring substantial costs and the diversion of resources.

We may face challenges and risks in connection with possible investments and acquisitions as well as forming joint ventures, including identifying suitable opportunities and integrating acquired or new businesses and assets with our existing operations, which could interrupt our business operations or adversely affect our results of operations.

As part of our business strategy, we may seek to broaden our service offerings, obtain additional clients and strengthen our service quality by acquiring other companies or businesses or making strategic investments. However, our ability to implement our acquisition or investment strategy will depend on a number of factors, including the availability of suitable acquisition candidates at an acceptable cost or at all, our ability to compete effectively to attract and reach agreement with acquisition or investment candidates or joint venture partners on commercially reasonable terms, and the availability of financing to complete acquisitions or investment or joint ventures as well as our ability to obtain any required government approvals or licenses. As such, the identification of suitable acquisition or investment targets or joint venture candidates and the consummation of proposed acquisition or investment or joint venture transactions could be difficult, time consuming and costly, and we may not be able to successfully capitalize on identified opportunities. In addition, we cannot assure you that any particular acquisition or investment or joint venture transaction will produce the intended benefits or synergies. For example, we recorded impairment loss of RMB 32.2 million (US$4.7 million) in the fiscal year ended March 31, 2017 related to our investment in certain companies providing online education and K-12 related services. In addition, we may not be successful in integrating acquisitions with our existing operations and personnel. Moreover, the acquisitions or investment we pursue may require us to expend significant management and other resources, which may result in interruption to our business operations.

There are other risks associated with acquisitions, including:

· unforeseen or hidden liabilities, including exposure to legal proceedings, associated with newly acquired companies;

· failure to generate sufficient revenues to offset the costs and expenses of acquisitions;

· integration of the management of the acquired business into our own;

· potential impairment losses or amortization expenses relating to goodwill and intangible assets arising from any of such acquisitions, which may materially reduce our net income or result in a net loss;

· potential conflicts with our existing employees as a result of our integration of newly acquired companies; and

· possible contravention of Chinese regulations applicable to such acquisitions.

Furthermore, raising capital to finance acquisitions or investments could cause earnings or ownership dilution to your shareholding interests, which in turn could result in losses to you. Any one or a combination of the above risks could interrupt our business operations and adversely affect our results of operations.

The listing of the shares of our wholly-owned subsidiary ATA Online (Beijing) Education Technology Co., Ltd. or ATA Online, on stock exchanges in China may not provide the benefits we anticipate, and the listing could negatively impact holders of our ADSs.

To provide ATA Online with the ability and flexibility to raise funds from the PRC capital markets for business expansion, we restructured our testing services business and online education services into our wholly-owned subsidiary ATA Online and listed its shares on the National Equities Exchange and Quotations, an emerging over-the-counter market in China (the New Third Board) in December 2015.

The listing of the shares of ATA Online on the New Third Board may not realize the anticipated benefits of such listing, and ATA Onlines operation as a listed company may result in distraction of ATA management. Although ATA Online remains our consolidated subsidiary after the listing, the ownership interest of our ADS holders in the earnings of ATA Onlines operations could be diluted, depending on the amount of funds raised, the returns on that funds and the manner in which that funds is raised (debt or equity). In addition, volatility in the trading price of our ADSs may increase due to events more specifically impacting ATA Onlines share trading price and operations. Our influence over the election of ATA Onlines board of directors will be decreased if ATA Onlines shareholders appoint directors who are independent of ATA.

We may need additional capital and any failure by us to raise additional capital on terms favorable to us, or at all, could limit our ability to grow our business and develop or enhance our product and service offerings to respond to market demand or competitive challenges.

Capital requirements are difficult to plan in our rapidly changing industry. We believe that our current cash and expected future cash flows from operations will be sufficient to meet our anticipated working capital and capital expenditures for the next 12 months and the foreseeable future beyond that point. We may, however, require additional cash resources due to changed business conditions or other future developments, including any investments or acquisitions we may decide to pursue. If our sources of liquidity are insufficient to satisfy our cash requirements, we may seek to sell additional equity or debt securities or obtain a credit facility. The sale of additional equity securities could result in dilution to our shareholders. The incurrence of indebtedness would result in increased debt service obligations and could require us to agree to operating and financing covenants that would restrict our operations. Our ability to obtain additional capital on acceptable terms is subject to a variety of uncertainties, including:

· investors perception of, and demand for, securities of computer-based testing and education companies;

· conditions of the U.S., PRC and other capital markets in which we may seek to raise funds;

· our future results of operations and financial condition;

· Chinese government regulation of foreign investment in China;

· economic, political and other conditions in China; and

· Chinese government policies relating to the borrowing and remittance of foreign currency outside China.

We cannot assure you that financing will be available in amounts or on terms acceptable to us, if at all. Any failure by us to raise additional funds on terms favorable to us, or at all, could limit our ability to grow our business and develop or enhance our product and service offerings to respond to market demand or competitive challenges.

We may be unable to maintain an effective system of internal control over financial reporting, and as a result we may be unable to accurately report our financial results or prevent fraud.

We are subject to provisions of the Sarbanes-Oxley Act of 2002. Section 404 of the Sarbanes-Oxley Act requires that we include a report from management on the effectiveness of our internal control over financial reporting in our annual reports on Form 20-F. Our management concluded that our internal control over financial reporting is effective as of March 31, 2017, and our independent registered public accounting firm reported on our internal controls over financial reporting. However, if we fail to maintain effective internal control over financial reporting in the future, our management and our independent registered public accounting firm may not be able to conclude that we have effective internal control over financial reporting at a reasonable assurance level. Our failure to maintain effective internal control over financial reporting could result in a loss of investor confidence in the reliability of our reporting processes, which could materially and adversely affect the trading price of our ADSs.

Our reporting obligations as a public company will continue to place a significant strain on our management, operational and financial resources and systems for the foreseeable future. Our failure to maintain effective internal control over financial reporting could result in the loss of investor confidence in the reliability of our financial reporting processes, which in turn could harm our business and negatively impact the trading price of our ADSs.

Our independent registered public accounting firms audit documentation related to their audit reports included in this annual report may include audit documentation located in China. The Public Company Accounting Oversight Board currently cannot inspect audit documentation located in China and, as such, you may be deprived of the benefits of such inspection.

Our independent registered public accounting firm that issues the audit reports included in our annual reports filed with the U.S. Securities and Exchange Commission, or SEC, as auditors of companies that are traded publicly in the United States and a firm registered with the U.S. Public Company Accounting Oversight Board (United States), or the PCAOB, is required by the laws of the United States to undergo regular inspections by the PCAOB to assess its compliance with the laws of the United States and professional standards. However, audit documentations located in China are not currently inspected by the PCAOB because the PCAOB is currently unable to conduct inspections without the approval of the PRC authorities.

Inspections conducted by the PCAOB outside of China have identified deficiencies in those firms audit procedures and quality control procedures, which may be addressed as part of the inspection process to improve future audit quality. The lack of PCAOB inspections in China prevents the PCAOB from regularly evaluating audit documentation located in China and its related quality control procedures. As a result, investors may be deprived of the benefits of PCAOB inspections.

The inability of the PCAOB to conduct inspections in China makes it more difficult to evaluate the effectiveness of our auditors audit procedures or quality control procedures as compared to audits outside of China that are subject to PCAOB inspections. Investors may lose confidence in our reported financial information and procedures and the quality of our financial statements.

Our independent registered public accounting firm may be temporarily suspended from practicing before the SEC if unable to continue to satisfy the SEC investigation requests in the future. If a delay in completion of our audit process occurs as a result, we could be unable to timely file certain reports with the SEC, which may lead to the delisting of our stock.

On January 22, 2014, Judge Cameron Elliot, an SEC administrative law judge, issued an initial decision suspending the Chinese member firms of the Big Four accounting firms, including our independent registered public accounting firm, from practicing before the SEC for six months. In February 2014, the initial decision was appealed. While under appeal and in February 2015, the Chinese member firms of the Big Four accounting firms reached a settlement with the SEC. As part of the settlement, each of the Chinese member firms of Big Four accounting firms agreed to settlement terms that include a censure, undertakings to make a payment to the SEC, procedures and undertakings as to future requests for documents by the SEC, and possible additional proceedings and remedies should those undertakings not be adhered to.

If the settlement terms are not adhered to, our independent registered public accounting firm may be suspended from practicing before the SEC which could in turn delay the timely filing of our financial statements with the SEC. In addition, it could be difficult for us to timely identify and engage another qualified independent registered public accounting firm to replace our current one. A delinquency in our filings with the SEC may result in NASDAQ initiating investigation procedures, which could adversely harm our reputation and have other material adverse effects on our overall growth and prospects.

We may be classified as a passive foreign investment company, which could result in adverse U.S. federal income tax consequences to U.S. holders of our ADSs or common shares.

We believe that we were not a passive foreign investment company, or PFIC, for U.S. federal income tax purposes for our taxable year ended March 31, 2017, and we do not expect to be a PFIC in any future taxable year. However, PFIC status is tested each year and depends on the composition of our assets and income and the value of our assets from time to time. Since we currently hold, and expect to continue to hold, a substantial amount of cash and other passive assets and, since the value of our assets is to be determined in large part by reference to the market prices of our ADSs and common shares, which is likely to fluctuate over time, there can be no assurance that we will not be a PFIC for any future taxable year. If we are a PFIC for any taxable year during which a U.S. investor held our ADSs or common shares, certain adverse U.S. federal income tax consequences would apply to the U.S. investor. See Item 10. Additional Information E. Taxation United States Federal Income Taxation Passive Foreign Investment Company.

Risks Relating to Regulation of Our Business

If the China Securities Regulatory Commission, or CSRC, or another PRC regulatory agency determines that CSRC approval was required in connection with our initial public offering, we may become subject to penalties.

On August 8, 2006, six PRC regulatory agencies, including the CSRC, promulgated the Provisions Regarding Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the M&A Rule, which became effective on September 8, 2006. The M&A Rule, among other things, requires that an offshore company controlled by PRC companies or individuals that has acquired a PRC domestic company for the purpose of listing the PRC domestic companys equity interest on an overseas stock exchange must obtain the approval of the CSRC prior to the listing and trading of such offshore companys securities on an overseas stock exchange. On September 21, 2006 the CSRC, pursuant to the M&A Rule, published on its official web site procedures specifying documents and materials required to be submitted to it by offshore companies seeking CSRC approval of their overseas listings.

Our PRC counsel, Jincheng Tongda & Neal Law Firm, advised us that CSRC approval was not required for our initial public offering in February 2008 because the CSRC approval required under the M&A Rule only applies to an offshore company that has acquired a domestic PRC company for the purpose of listing the domestic PRC companys equity interest on an overseas stock exchange, while (i) we obtained our equity interest in each of our PRC subsidiaries by means of direct investment other than by acquisition of the equity or assets of a PRC domestic company in 2008, (ii) our former contractual arrangements with ATA Online (please see Item 7. Major Shareholders and Related Party TransactionsB. Related Party Transactions. for more details) do not constitute the acquisition of ATA Online, (iii) the M&A Rule does not apply to the acquisition by ATA Learning, a wholly foreign owned enterprise, and (iv) although Article 11 of the M&A Rule prohibits the circumvention of the M&A Rule through establishing FIEs, ATA Learning was established in 2003 before the M&A Rule was promulgated, which makes this acquisition not a circumvention of the M&A Rule. However, if it is determined that CSRC approval was required, we may face regulatory actions or other sanctions from the CSRC or other PRC regulatory agencies. These regulatory agencies may impose fines and penalties on our operations in China, limit our operating privileges in China, or take other actions that could have a material adverse effect on our business, financial condition, results of operations, reputation and prospects, as well as the trading price of our ADSs.

Because we may rely on dividends and other distributions on equity paid by our current and future Chinese subsidiaries for our cash requirements, restrictions under Chinese law on their ability to make such payments could materially and adversely affect our ability to grow, make investments or acquisitions that could benefit our business, pay dividends to you, and otherwise fund and conduct our businesses.

We have adopted a holding company structure, and our holding companies may rely on dividends and other distributions on equity paid by our current and future Chinese subsidiaries for their cash requirements, including the funds necessary to service any debt we may incur or financing we may need for operations other than through our Chinese subsidiaries. Chinese legal restrictions permit payments of dividends by our Chinese subsidiaries only out of their accumulated after-tax profits, if any, determined in accordance with PRC GAAP. Our Chinese subsidiaries are also required under Chinese laws and regulations to allocate at least 10% of their after-tax profits determined in accordance with PRC GAAP to statutory reserves until such reserves reach 50% of the companys registered capital. Allocations to these statutory reserves and funds can only be used for specific purposes and are not transferable to us in the form of loans, advances or cash dividends. As of March 31, 2017, our Chinese subsidiaries allocated RMB 55.2 million ($8.0 million) to the general reserve fund, which is restricted for distribution to the Company. We are in full compliance with PRC laws and regulations relating to such allocations. Any limitations on the ability of our Chinese subsidiaries to transfer funds to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends and otherwise fund and conduct our business.

The discontinuation of any of the preferential tax treatments currently enjoyed by our subsidiaries in the PRC could materially increase our tax obligations.